Trump SPAC Stock Surge: A Hilarious Market Moment

Initial Reactions to Trump's New Venture

Upon the announcement that former President Donald Trump was developing a media and technology firm and planning to launch it through a special-purpose acquisition company (SPAC), many observers immediately considered the possibility of shorting the stock.

Several factors contributed to this sentiment. Previous attempts at right-leaning social media platforms have largely failed. The company’s objectives appeared ambitious, especially considering its limited funding and the strong competition. Furthermore, the absence of an existing product or revenue history made financial modeling challenging. These are just some of the reasons for caution.

Unexpected Market Response

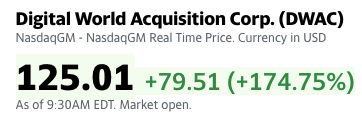

Despite these concerns, shares of Digital World Acquisition Corp, the SPAC involved, experienced a significant increase in value following the news. This upward trend is continuing today.

It’s important to note that DWAC represents the Class A shares of Digital World Acquisition Corp, while DWACU denotes the same equity with an attached warrant. The latter shares have seen a smaller increase, which is somewhat unusual.

Valuation and Comparisons

Currently, DWAC boasts a market capitalization of approximately $4.7 billion, according to Yahoo Finance. This valuation positions Digital World – also known as Trump Media and Technology Group (TMTG) – as a recent addition to the ranks of “unicorn” companies in the media and technology sectors.

This public valuation is particularly noteworthy given the early stage of development of the company merging with Digital World. It’s reasonable to describe it as a startup. The situation defies conventional logic, even within the context of 2021 and the SPAC boom.

Limited Fundamentals

The primary asset of TMTG is the Trump name. The company intends to utilize funds from the SPAC to finance its operations, rather than relying on Trump’s personal wealth. Indeed, the financial backing of the individual whose name is central to the business is limited.

The company’s presentation highlighted the growing popularity of podcasts, a point that, while true, feels somewhat inconsequential. This underscores the lack of substantial underlying fundamentals.

The "Meme Stock" Potential

The unusual nature of the company suggests it could become a “memestock,” or stonk. Companies that appear particularly unconventional often attract this type of speculative investment. For example, GameStop experienced a surge in stock price despite the decline of physical retail. Similarly, Hertz saw increased investment despite challenges in the car rental industry.

Therefore, the upward trajectory of DWAC is almost predictable. The stock’s rise is both amusing and a concerning reflection on the efficiency of market theory. A stock’s appeal as a meme is often inversely proportional to its viability as a business.

Consequently, TMTG has increased in value by a substantial percentage, a result that is logical only in its inherent illogic.

While a typical response might be to disengage, further analysis is required. This situation will be monitored, and updates will be provided. Good luck to all investors today.

Related Posts

Peripheral Labs: Self-Driving Car Sensors Enhance Sports Fan Experience

YouTube Disputes Billboard Music Charts Data Usage

Oscars to Stream Exclusively on YouTube Starting in 2029

Warner Bros. Discovery Rejects Paramount Bid, Calls Offer 'Illusory'

WikiFlix: Netflix as it Might Have Been in 1923