Samsung Reclaims No. 1 Spot in India Smartphone Market | Latest News

Xiaomi, the leading smartphone vendor in India for the past three years, has experienced a shift in its market position, with Samsung now taking the lead in the world’s second-largest smartphone market, as indicated by a recent report.

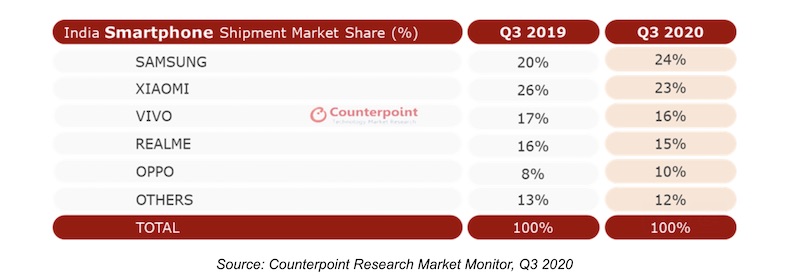

Data from the marketing research company Counterpoint suggests that Samsung held a 24% share of the Indian smartphone market in the quarter concluding in September of this year, surpassing Xiaomi’s 23% share. (For comparison, during the third quarter of 2019, Samsung accounted for 20% of the Indian smartphone market while Xiaomi captured 26%.)

The findings from Counterpoint differ from a report released last week by the research firm Canalys. Canalys reported that Xiaomi maintained the top position in India during Q3 2020, with a market share of 26.1%, exceeding Samsung’s 20.4%.

However, both firms concur that the Indian smartphone market demonstrated a significant recovery during the quarter. Counterpoint reported that over 53 million smartphone units were shipped in Q3 2020, representing a 9% increase compared to the same period last year. (Canalys estimated the figure to be approximately 50 million units.)

According to Counterpoint, Samsung’s shipments in Q3 2020 increased by 32% year-over-year. The company has benefited from a recent focus on expanding its online sales channels and the introduction of several competitively priced smartphone models in recent months, according to analysts at Counterpoint.

Xiaomi, which began operations in India in 2014 and initially relied on exclusive online sales channels, remains the leading online brand in the country, according to Counterpoint. However, the company, which considers India its largest market outside of China, is facing challenges due to increasing anti-China sentiment among Indian consumers, particularly as tensions between the two nations have risen in recent quarters.

This situation could potentially lead to further shifts in the market in the coming months. Micromax, an Indian smartphone manufacturer that previously held a dominant market position, announced earlier this month its plans to launch a new smartphone sub-brand named “In.” Rahul Sharma, the head of Micromax, stated that the company will invest $67.9 million in this new brand.

In a video shared on Twitter this month, Sharma asserted that Chinese smartphone manufacturers had negatively impacted local handset makers, but that the time had come for a resurgence. “Our goal is to re-establish India’s presence on the global smartphone landscape with ‘in’ mobiles,” he stated.

It is important to note that prior to the arrival of Chinese smartphone manufacturers, who now control over 70% of the Indian smartphone market, Indian firms frequently collaborated with Chinese phone manufacturers. Chinese companies produced the phones, which were then sold to Indian firms under white-label agreements.

These Indian firms subsequently sold the phones to consumers within the country. Ultimately, Chinese smartphone manufacturers bypassed the intermediaries and began selling superior smartphone models directly to Indian consumers at more competitive prices, explained Jayanth Kolla, a veteran of the smartphone industry and chief analyst at the consultancy firm Convergence.

India has also recently approved applications from 16 smartphone and electronics companies for a $6.65 billion incentive program as part of New Delhi’s federal initiative to stimulate domestic smartphone production over the next five years. Foxconn (along with two other Apple contract manufacturers), Samsung, Micromax, and Lava (another Indian brand) are among the companies eligible to receive these incentives.

Notably absent from the list are Chinese smartphone manufacturers such as Xiaomi, Oppo, Vivo, OnePlus, and Realme.

Related Posts

Pickle Robot Appoints Tesla Veteran as First CFO

Meta Pauses Horizon OS Sharing with Third-Party Headsets

Amazon Reportedly in Talks for $10B OpenAI Investment

Meta AI Glasses Enhance Hearing - New Feature

Whole Foods to Implement Smart Waste Bins from Mill | 2027