Jackpocket Raises $120M for Mobile Gaming Expansion

The Rise of Mobile Lottery Gaming: Jackpocket Secures $120 Million Funding

Applications enabling users to perform tasks previously requiring in-person interaction have experienced substantial growth over the last 20 months. Jackpocket, a platform allowing users to purchase lottery tickets via a mobile app, is a prime example, recently announcing a significant funding round fueled by its own expansion. Currently serving 2.5 million active users across 10 U.S. states, Jackpocket has secured $120 million in a Series D funding round.

Expansion Plans and Technological Investments

CEO and founder Peter Sullivan stated the funds will be allocated towards broadening the company’s offerings beyond lottery ticket sales, venturing into a more diverse range of mobile gaming options. Furthermore, the company intends to extend its reach to additional markets within the U.S. and internationally, both independently and through strategic partnerships.

Sullivan anticipates expansion into at least five additional states by the end of the first quarter. Alongside this geographical growth, the company plans to invest in technology, integrating “best practices” from e-commerce, subscription services, and mobile wallet platforms, while simultaneously exploring new gaming formats.

Beyond Lotteries: Exploring New Gaming Avenues

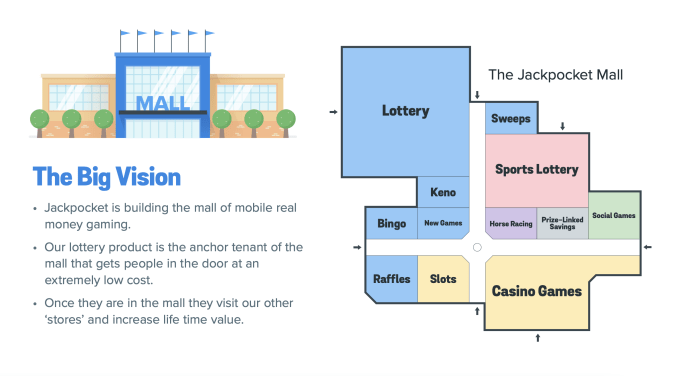

A significant portion of lottery revenue is allocated to beneficial causes. Jackpocket aims to capitalize on this by exploring new areas such as raffles, sweepstakes, bingo, and social casino games. The company’s objective is to offer a wider variety of engaging gameplay, increased winning opportunities, and expanded avenues for charitable contributions.

Jackpocket’s expansion strategy, as outlined in its recent pitch deck, focuses on diversifying its gaming portfolio and reaching a broader audience.

Investment Details and Backers

Left Lane Capital spearheaded the investment, with participation from notable figures including comedian Kevin Hart, Whitney Cummings, Mark Cuban, and Manny Machado. Existing investors such as Greenspring Associates, The Raine Group, Anchor Capital, Gaingels, Conductive Ventures, and Blue Run Ventures also contributed, alongside new investor Santa Barbara Venture Partners. The company’s headquarters are in New York, with an additional operation based in Santa Barbara, California.

Sullivan confirmed the company is not disclosing its valuation at this time, but noted the total funding raised now approaches $200 million.

Rapid Growth and Market Opportunity

Jackpocket’s growth has been significant, with its active user base increasing by 300% in the last eight months. This acceleration follows a $50 million Series C round raised in February, which valued the company at $160 million post-money, according to PitchBook data.

The inspiration for Jackpocket stemmed from Sullivan’s father, a working-class individual from Brooklyn who regularly played the state lottery but lacked computer skills. Recognizing a gap in the market, Sullivan envisioned an app that would bring the convenience of online ordering to lottery ticket purchases.

“We positioned ourselves as the Uber or Instacart for lottery,” Sullivan explained.

How Jackpocket Works

Jackpocket functions as both a lottery ticket storefront and a virtualized lottery experience. Users order tickets through the mobile app, and Jackpocket purchases the tickets on their behalf using proprietary software. Each ticket is digitally “scanned” and watermarked for authenticity and uniqueness, allowing players to view their tickets.

The platform incorporates various security measures to ensure regulatory compliance, including age verification, geographical location checks using GPS technology, and VPN detection. Users are required to upload identification to confirm their age and identity.

Responsible Gaming and Business Model

Jackpocket prioritizes responsible gaming by monitoring user spending and implementing an initial daily deposit limit of $100, which users can adjust downwards. The company’s revenue model is based on a 9% fee applied to customer deposits; winnings and withdrawals are not subject to fees.

Initially, securing funding proved challenging due to the perceived taboo surrounding real-money gaming. However, the success of companies like FanDuel has shifted investor sentiment.

“Nine years ago investors wouldn’t talk to us, but I knew lottery would be the key here,” Sullivan said. “It is the largest amount of real money gaming, largest net and lightest touch point and it works well cross-selling it to other formats.”

The Lottery Market: A Significant Opportunity

Industry data from North American State and Provincial Lotteries estimates the total annual consumer spend on lotteries at $85.6 billion. This figure surpasses spending in several other leisure categories, including books, movie tickets, video games, concerts, and sporting events.

Jackpocket is attracting a younger and more affluent demographic, with approximately 70% of its buyers under the age of 45. This shift towards tech-savvy consumers aligns well with the app-based experience.

Impact of the Pandemic

The pandemic significantly boosted companies like Jackpocket, as consumers shifted towards online purchasing and avoided in-person visits to convenience stores. Many stores that remained open adopted delivery services, further reducing the convenience of traditional ticket purchases.

Future Outlook: Cross-Selling and Partnerships

The potential for “cross-selling” other gaming formats and forging partnerships with companies like instant grocery delivery services represents a key area for future growth. These partnerships could leverage the existing retail network of convenience stores in a digital format.

Harley Miller, founder and managing partner of Left Lane Capital, stated, “Mobile gaming and lottery is experiencing an exciting and unprecedented level of growth and expansion. At Left Lane, it’s clear to us that Jackpocket is spearheading this progress and innovating at a pace never seen before in this industry.”

Updated with a few minor clarifications on spending limits, how Jackpocket works to purchase tickets, and the commission structure.

Related Posts

Disney Cease and Desist: Google Faces Copyright Infringement Claim

Spotify's AI Prompted Playlists: Personalized Music is Here

YouTube TV to Offer Genre-Based Plans | Cord Cutter News

Google Tests AI Article Overviews in Google News

AI Santa: Users Spend Hours Chatting with Tavus' AI