Bumble IPO: Dating App Files for Initial Public Offering

The dating and professional networking platform Bumble has submitted its initial public offering (IPO) paperwork.

The organization, established by a previous co-creator of Tinder – which is part of IAC – intends to be listed on the Nasdaq exchange under the stock ticker “BMBL.” Reports regarding Bumble’s intention to become a publicly traded company initially surfaced in December.

Whitney Wolfe Herd, the current CEO of Bumble, was an early member of the Tinder team before founding Bumble. She initiated legal action against Tinder alleging sexual harassment and discrimination, experiences that significantly motivated her to develop a dating application empowering women.

In 2019, Wolfe Herd assumed leadership of MagicLab, which was subsequently rebranded as Bumble Group, as part of a $3 billion agreement with Blackstone. This transition followed allegations of harassment within the firm and resulted in the departure of Badoo’s founder and CEO, Andrey Andreev.

The company is seeking to enter the public market during a period of significant activity for initial public offerings, with investors demonstrating strong interest in IPOs from companies supported by venture capital throughout the latter part of 2020 and into early 2021. Several formerly private companies, including Airbnb and Affirm, have experienced substantial gains in value due to the prices offered by public investors, potentially encouraging a higher volume of IPO submissions than might typically be observed.

The IPO filing document is available for review here. TechCrunch will provide a detailed analysis of the document later today, but we have extracted key figures to assist with your independent investigation.

Prior to reviewing the financials, the composition of the company’s board of directors – which is more than 70% female – is already receiving positive recognition. Now, let’s examine the company’s financial data.

A Review of Bumble’s IPO Documentation

Let's analyze Bumble by examining its user base, financial performance, and ownership structure.

Regarding user activity, Bumble demonstrates considerable popularity, which is essential for a dating service aiming for a public offering. The company reports 42 million monthly active users (MAUs) as of the third quarter of 2020—a figure many companies leverage when pursuing an IPO, as third-quarter results from 2020 often serve as a benchmark due to the time required to finalize fourth-quarter and full-year data.

Of those 42 million MAUs, 2.4 million represent total paying users through the first nine months of 2020. Consequently, the proportion of paying users relative to MAUs is a fraction smaller than simply dividing 2.4 million by 42 million.

Concerning financial figures, it’s important to remember that Bumble previously sold a controlling stake in the company. This ownership arrangement introduces complexity when evaluating Bumble’s financial results.

Following the IPO, Bumble Inc. will function as a holding company, with its primary asset being a controlling interest in Bumble Holdings, according to the S-1 filing. Therefore, how is Bumble Holdings performing?

Let’s examine the numbers. After careful analysis of the company’s S-1 filing, which contains detailed accounting information, Bumble achieved the following during the first nine months of 2019:

- Revenues totaling $362.6 million

- Net income of $68.6 million

Subsequently, combining relevant data points, Bumble’s performance for the same period in 2020 was recorded as:

- Revenues of $416.6 million

- Net income of -$116.7 million

For clarity, we are utilizing the “Net (loss) earnings” line to assess profitability, rather than the “Net (loss) earnings attributable to owners / shareholders” to maintain simplicity in this initial assessment.

While Bumble experienced moderate revenue growth through the third quarter of 2020, it also saw a significant shift to losses when calculated according to Generally Accepted Accounting Principles (GAAP). However, the company’s adjusted profitability increased over the same timeframe. Specifically, Bumble’s adjusted EBITDA, a non-GAAP metric, rose from $80.0 million in the first three quarters of 2019 to $108.3 million in the corresponding period of 2020.

Although we typically extend some understanding to rapidly expanding companies regarding adjusted metrics, the disparity between Bumble’s GAAP losses and its EBITDA results presents a considerable point for consideration. Bumble also transitioned from positive free cash flow during the first nine months of 2019 to negative figures in the first quarters of 2020.

Extrapolating Bumble’s revenue from the first three quarters of 2020 to a full-year projection suggests potential revenues of $555.5 million for 2020. Even applying a conservative valuation multiple typical of software companies, the company’s worth would exceed the previously discussed $3 billion estimate.

However, the substantial unprofitability observed in 2020 could potentially moderate its ultimate valuation. Further analysis of the filing will provide additional insights.

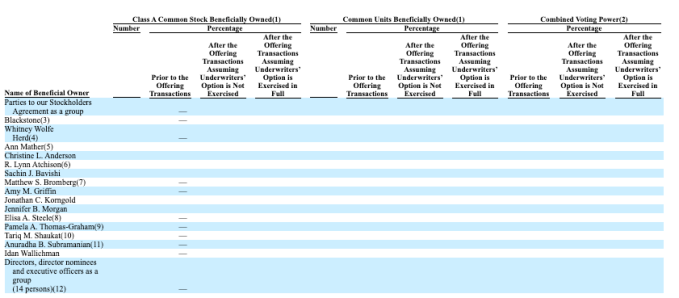

Lastly, regarding ownership, the company’s filing provides surprisingly limited information. The section detailing principal shareholders appears as follows:

We will share further details as they become available. For now, we encourage you to review the S-1 filing yourself.

Related Posts

Peripheral Labs: Self-Driving Car Sensors Enhance Sports Fan Experience

YouTube Disputes Billboard Music Charts Data Usage

Oscars to Stream Exclusively on YouTube Starting in 2029

Warner Bros. Discovery Rejects Paramount Bid, Calls Offer 'Illusory'

WikiFlix: Netflix as it Might Have Been in 1923