Apple Updates: Wall Street's Reaction - Tech News

Apple's WWDC Keynote Met with Market Indifference

Apple’s Worldwide Developers Conference (WWDC) keynote unveiled a comprehensive array of updates today. These ranged from a new macOS iteration to a revitalized watchOS, alongside a fresh iOS release. Improvements to privacy features, enhancements to FaceTime, and the introduction of iCloud+ were also highlighted, offering something for a wide spectrum of users.

A Broad Range of Announcements

The keynote demonstrated the scale of Apple’s current operations. As a major technology company, Apple now manages numerous projects simultaneously. Consequently, the presentation involved a detailed overview of its entire platform ecosystem, with announcements pertaining to each.

Despite clear evidence of substantial investment in the software aspects of its business, particularly its services sector, Wall Street responded with a notable lack of enthusiasm.

This reaction, while typical, remains somewhat perplexing.

The Disconnect Between Updates and Market Response

Investors, at least theoretically, prioritize future cash flows. These anticipated flows are derived from projected revenues, which are fueled by product updates that stimulate growth in services, software, and hardware sales. Apple’s presentation today directly addressed these areas.

Yet, Wall Street appeared to dismiss the factors that will influence its future earnings projections, expressing a lack of significant interest.

Throughout much of the day, Apple’s shares experienced a slight decline. However, they began to recover as trading neared its conclusion, not due to the company’s announcements, but rather because of a broader upward trend in the Nasdaq.

Stock Performance Charts

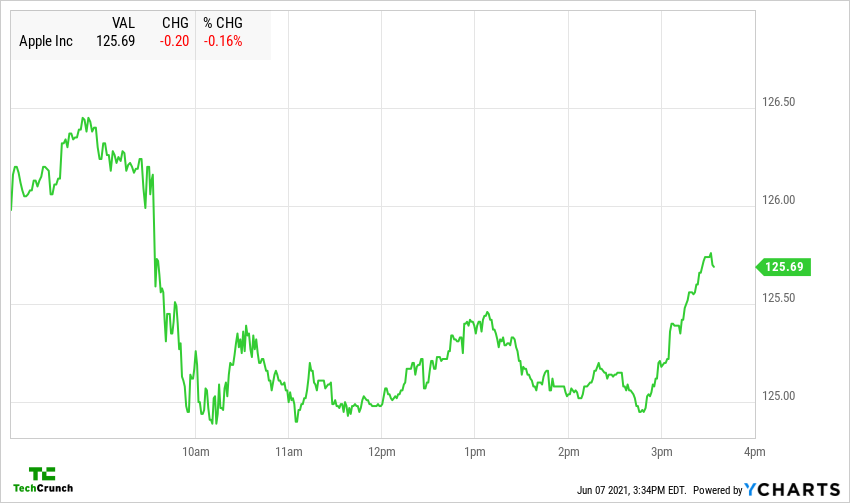

Here is a chart illustrating Apple’s stock performance, sourced from YCharts:

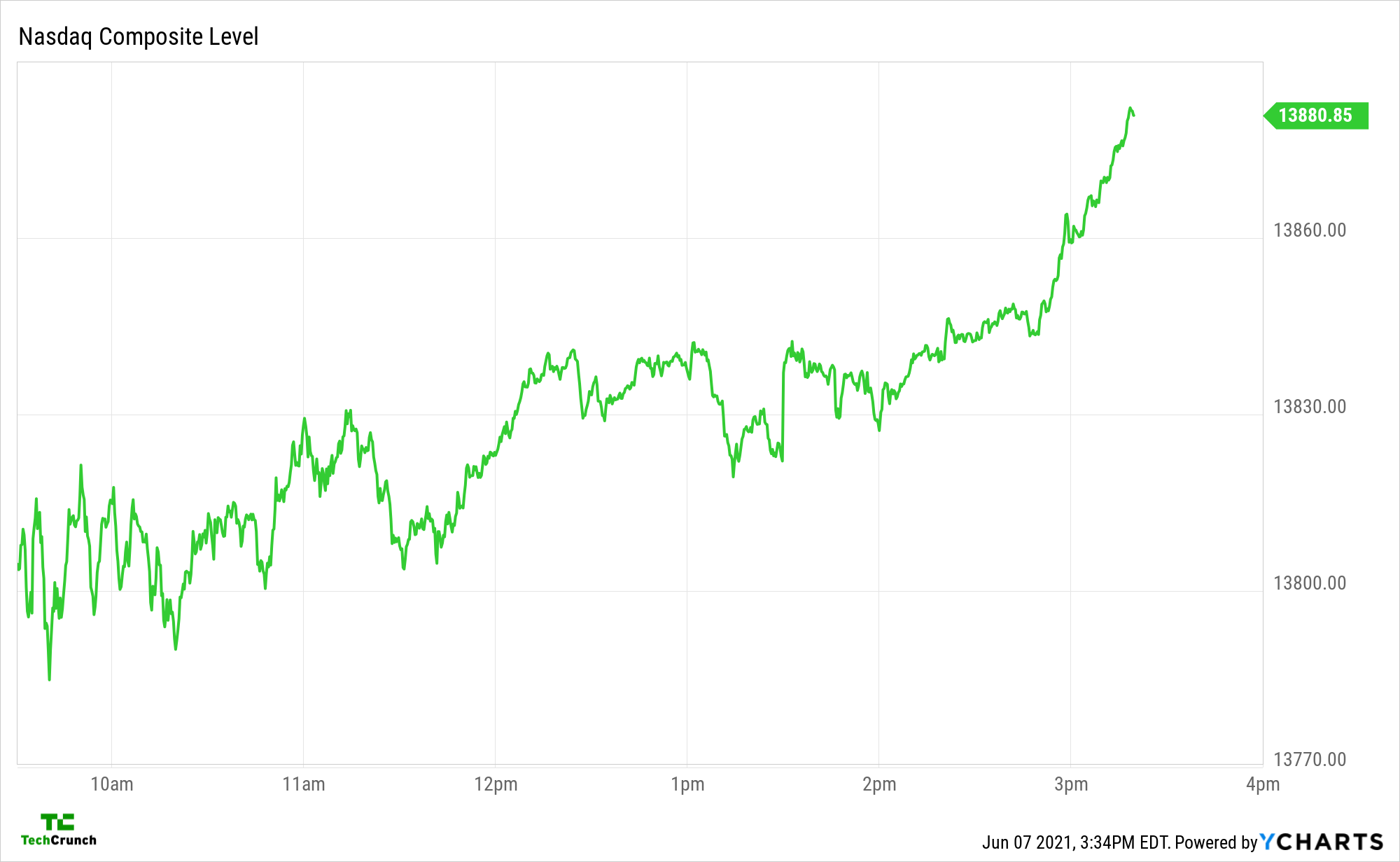

And here is a chart showing the Nasdaq’s performance:

These charts offer limited insight. Apple’s stock saw a minor decrease, while the Nasdaq experienced a slight increase. Subsequently, the Nasdaq’s gains expanded, and Apple’s stock mirrored this trend. This is a positive outcome, but ultimately not particularly significant.

Market Expectations and Apple’s Size

Following another substantial Apple event that will influence the performance of all Apple platforms – key contributors to profitable hardware sales – the market appears confident that its existing valuations are accurate. There is no perceived need for adjustments.

Alternatively, Apple’s immense size may lead investors to anticipate growth aligned with overall GDP. This would be a somewhat ironic observation. Further coverage of the Apple event can be found here for those who require additional information.

Related Posts

Live Video to Emergency Services on Android

Unconventional AI Raises $475M Seed Round

Ring AI Facial Recognition: New Feature Raises Privacy Concerns

Google AI Glasses: Release Date, Features & Everything We Know

Pebble AI Smart Ring: Record Notes with a Button - $75