Qualtrics S-1 Filing: A Deep Dive

The Exchange is pausing its holiday schedule to analyze the recently submitted Qualtrics S-1 filing. The column and newsletter will resume on January 4th.

This afternoon, Qualtrics, a software provider specializing in surveying employees, customers, and other groups, submitted its initial public offering paperwork. This marks the second attempt for the Utah-based company to become publicly traded; the first attempt was unsuccessful after SAP acquired it for approximately $8 billion in cash.

The Exchange provides insights into startups, financial markets, and investment. Find it each morning on Extra Crunch, or subscribe to The Exchange newsletter every Saturday.

SAP revealed in late July of this year that Qualtrics would be separated through an IPO, completing the company’s journey from private to public and back again.

This new S-1 document – a copy of the 2018 version can be found here – differs significantly from the previous one. Qualtrics has grown in size and maturity, and its financial situation is more intricate as it prepares to operate independently from its current parent company.

Qualtrics plans to trade on the Nasdaq exchange using the stock ticker “XM.”

Reflecting on my previous conversations with Ryan Smith, who was Qualtrics CEO at the time and currently serves as its chairman, and Bill McDermott, formerly SAP’s CEO and now leading ServiceNow, it’s surprising to recall that the acquisition occurred just two years ago.

The business landscape has evolved considerably since late 2018. We will now examine Qualtrics’ recent performance, its projected valuation range (note: it has increased), and any other relevant details we can uncover.

Analyzing the New Qualtrics S-1 Filing

Let's begin with some initial observations. SAP will maintain its position as the controlling shareholder following Qualtrics’ initial public offering, as detailed early in the S-1 document. Additionally, both Smith and Silver Lake are making investments in the company as part of this new offering.

Smith acquired six million shares, representing approximately 1% of the total stock, for $120 million last week. Meanwhile, the Silver Lake-led investment group is set to purchase a combined $550 million worth of the company’s stock through a two-stage transaction. Silver Lake initially purchased 15 million shares at $21.64 each last week and is scheduled to acquire an additional $225 million in stock at the eventual IPO price.

Regarding the potential price, the company’s IPO filing suggests Qualtrics may price its shares between $20 and $24. It is somewhat uncommon for a company preparing to go public to disclose a possible price range in its initial S-1 filing; however, as we will see, becoming an independent entity presents considerable challenges.

In this instance, the early disclosure of the potential IPO price range appears to be connected to an offer extended to employees, enabling them to exchange “existing Qualtrics Rights and SAP RSUs” for “awards linked to shares of our Class A common stock.” The terms of this exchange will be determined by a calculation factoring in the value of SAP stock and the final IPO price of Qualtrics.

Now, let’s examine the company’s revenue and growth trajectory.

Performance Overview

Qualtrics demonstrated continued growth following its acquisition. In 2018, the software company generated $295.5 million in subscription software revenue, alongside $106.4 million in services revenue, culminating in a total revenue of $401.9 million.

Total revenue increased to $591.2 million in 2019, signifying a growth rate of 47%. The company’s software revenue, which constitutes the majority of its income, grew by 45.5% in 2019, a slightly slower pace than its overall revenue expansion.

During the first nine months of 2020, the company’s revenues reached $550 million, an increase of 31.5% compared to the same period in 2019. Over the same timeframe, Qualtrics’ software revenues grew by just over 34%, exceeding the growth rate of its total revenues.

In terms of profitability, analyzing the company using “generally accepted accounting principles,” or GAAP, revealed a significant shift in 2019. The company reported a loss of $1 billion in 2019, in contrast to a loss of only $37.3 million in 2018.

In the first three quarters of 2020, the company’s net loss decreased to $258 million from $860.4 million during the corresponding period in 2019.

This change from near-breakeven to substantial unprofitability appears to be primarily due to the handling of the company’s equity compensation after the SAP acquisition. SAP settled vested equity compensation in cash rather than stock, which impacted the company’s GAAP results compared to expectations based on its 2018 S-1 filing.

Equity compensation and “cash settled stock-based compensation expense” at Qualtrics rose from $4.6 million in 2018 to $876.2 million in 2019. This figure is now decreasing, falling from $750.1 million in the first nine months of 2019 to $218 million during the same period of 2020.

Excluding stock-based compensation, the company is nearly profitable. In the third quarter of 2020, Qualtrics’ net loss of $85.7 million closely matched its share-based compensation cost of $84.1 million during the same period.

Considering the unique circumstances surrounding cash-settled stock-based compensation expenses due to SAP, Qualtrics’ non-GAAP gross margins and non-GAAP operating margins may be more indicative than traditional adjusted metrics. During the first nine months of 2020, Qualtrics’ non-GAAP gross margin was 75%, a slight decrease from its result during the same period of 2019.

Looking at its adjusted operating profit, Qualtrics experienced a 5% deficit during the first three quarters of 2020, an improvement from its -7% result during the same period of 2019.

In summary, Qualtrics is growing at a rate exceeding 30%, and after navigating some post-acquisition costs, which seem at least partially related to SAP’s handling of equity compensation, has returned to a more reasonable level of losses on a GAAP basis and is performing well when considering its adjusted (non-GAAP) results.

SaaS Metrics

Beyond the complexities of the SAP transaction, what insights can we glean about Qualtrics from a SaaS perspective? Let’s analyze the company’s net retention and remaining performance obligations (RPOs). The former metric should indicate how much more Qualtrics customers spend over time, while the latter represents future revenues the company has secured but not yet recognized.

Qualtrics calculates its net retention rate as follows:

Qualtrics reported net retention of 122% in its most recent quarter, and “120% in each of the last eight quarters.” This is nearly consistent with the company’s net retention rate when it last filed for IPO in 2018.

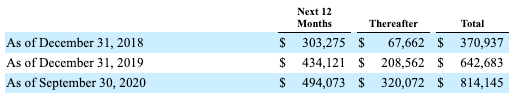

Regarding RPOs, Qualtrics defines this metric as “the amount of contracted future revenue that has not yet been recognized.” Here are the results:

The rate of gross dollar expansion in near-term RPOs slowed down from 2018-2019 to 2019-2020. However, the growth in longer-term RPO value appears stronger, although the absence of Q4 2020 results means a full three months of data is missing. Institutional investors will likely analyze this chart to forecast future growth rates.

Valuation Considerations

Finally, let’s consider Qualtrics’ potential valuation. The company’s listing includes 454,416,366 Class A shares owned by SAP, Ryan Smith, and Silver Lake. An additional 101,829,390 Class A shares are reserved for “future issuance under our equity compensation plans.” More shares will be offered in the IPO, along with potential underwriters’ options. Therefore, the total, fully diluted share count at Qualtrics will likely be around 600 million, with a simple share count of approximately 500 million.

This suggests that Qualtrics, using its most conservative share count and per-share price, could be valued around $10 billion. Utilizing our fully diluted share count estimate and a higher price, the valuation could exceed $14 billion.

Qualtrics concluded Q3 2020 with an annualized run rate of $771.4 million. This translates to a roughly 18x multiple based on its current maximum estimated valuation. This could be considered slightly conservative, given current market valuations. We will have to wait and see.

Further information regarding pricing will be provided as it becomes available.

Update December 29, 2020: Qualtrics incorporates churn into its net retention rate, aligning with standard industry reporting practices. The original version of this article incorrectly stated that churn was excluded. The “SaaS Metrics” section has been updated.

Related Posts

Peripheral Labs: Self-Driving Car Sensors Enhance Sports Fan Experience

Radiant Nuclear Secures $300M Funding for 1MW Reactor

Last Energy Raises $100M for Steel-Encased Micro Reactor

First Voyage Raises $2.5M for AI Habit Companion

on me Raises $6M to Disrupt Gift Card Industry