unit raises $18.6m to offer banking features as a service

Firms such as Stripe and Twilio have revolutionized online commerce by simplifying the integration of payment and communication functionalities into customer-facing applications, eliminating the need for extensive in-house development or expensive external integrations. Currently, a new company is launching and securing funding with the goal of achieving a similar transformation within the realm of financial services.

Unit has developed a platform enabling businesses to seamlessly incorporate banking services – including payment cards, checking accounts, cash advances, and money transfers – into their own offerings through an Application Programming Interface (API). Following a period of quiet development and customer acquisition, the company is now publicly announcing its availability, backed by $18.6 million in funding to fuel further expansion – through the addition of new capabilities, personnel recruitment, and user base growth.

The funding round includes contributions from a diverse group of investors reflecting the company’s origins in Israel and its current location in San Francisco. Participants include Better Tomorrow Ventures, Aleph, Flourish Ventures, Operator Partners, and TLV Partners, alongside a collective of 30 angel investors with significant experience in the fintech sector.

Itai Damti, CEO and co-founder alongside Doron Somech (CTO), explained that the company’s core objective is to facilitate the expansion of financial services for businesses already engaged in transactional relationships with their customers. Examples include on-demand transportation companies managing their driver fleets, or online bookkeeping platforms serving their user base, allowing them to cultivate stronger, more enduring connections through enhanced financial features.

“Businesses within the freelance economy are uniquely positioned to integrate a broader range of banking services into their platforms for freelancers,” Damti stated. Many have previously explored offering services like payment cards for commission payouts. Now, “they can also empower their freelancers to monitor expenses and receive payments more efficiently.”

Damti anticipates that simplifying the integration of these features will lead to a substantial increase in businesses adopting them. “We are already observing considerable interest,” he noted.

Traditional banks have been comparatively slow to adapt their services to the rapid pace of technological change, creating opportunities for new competitors aiming to capture market share by providing more personalized services, greater flexibility, and more competitive rates, all delivered through user-friendly mobile applications rather than traditional branch networks.

Unit believes an even greater opportunity exists in providing banking services by identifying existing workflows where individuals are already conducting business. The company suggests the recent global health crisis has accelerated this trend, as more people are conducting work online and seeking internet-based solutions.

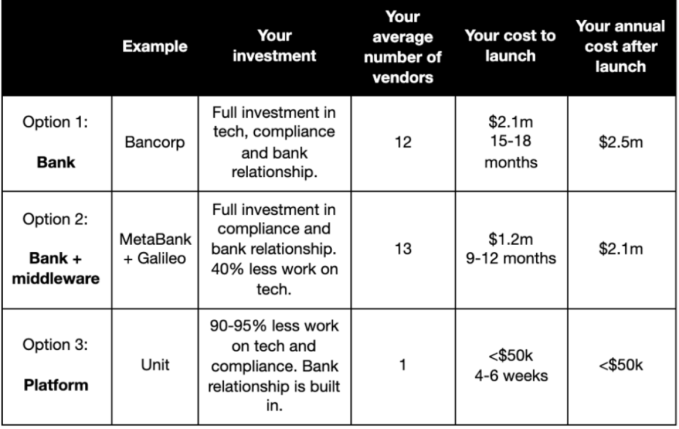

Historically, the costs – in terms of finances, time, and effort – associated with providing these services have been prohibitive for companies outside the fintech industry. Unit asserts that its API-based solution addresses this challenge:

Several other companies have recognized the potential of “financial services as a service” and are experiencing rapid growth in this market.

Rapyd, valued at $1.2 billion approximately a year ago, is a prominent example, with backing from investors including Stripe and other leading firms.

Stripe itself recently collaborated with banks to launch its own embedded business banking service, Stripe Treasury, further demonstrating the increasing competition in this area.

However, with a growing number of businesses transitioning online, opportunities remain for multiple players in the market.

“Technology and non-financial companies are integrating financial services to strengthen customer relationships and improve unit economics,” stated Emmalyn Shaw of Flourish Ventures. “This is a complex undertaking that requires robust compliance, and Unit provides best-in-class solutions. The expertise of executives like Amanda Swoverland, former Chief Risk Officer at Sunrise Bank, positions Unit to deliver superior compliance and seamless integration for businesses of all sizes.”

“Genuine innovation in financial services demands a technical partner capable of bridging the gap between finance and technology, and Unit excels in this regard. We have invested in numerous fintech companies over the years and believe that many of the next-generation businesses will be built on the Unit platform,” added Sheel Mohnot of Better Tomorrow Ventures.