DoorDash IPO Winners: VCs and Founders Who Benefited

Following considerable anticipation and widespread discussion, the S-1 filing for DoorDash is now available. Alex has already detailed the key aspects, but a closer examination reveals which entities are benefiting most from the success of this leading delivery service.

DoorDash’s documentation shows the company secured a total of $2.485 billion in funding through a seed round and eight subsequent Series A-H rounds. The three venture capital firms with the most significant ownership, as stated in the filing, are SoftBank Vision Fund, Sequoia, and GIC of Singapore, identified as Greenview (distinct from the similarly named fund previously involved in legal proceedings).

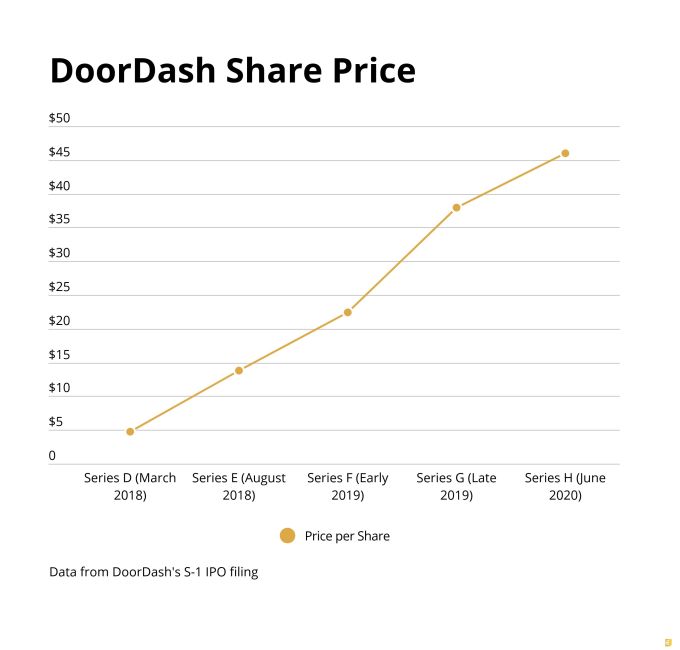

The latest valuation per share, established during the Series H round in June, was $45.91. Throughout the company’s history, investors acquired shares at an average price of $8.73.

Before analyzing the venture capital returns, let’s consider the founders and their equity positions. According to the filing, co-founder and CEO Tony Xu currently holds 5.2% of DoorDash, excluding any potential future performance-based incentives. Co-founders Andy Fang, serving as CTO, and Stanley Tang, the chief product officer, each own 4.7% of the company. Evan Moore, a fourth co-founder who previously led operations and is now a partner at Khosla, DoorDash’s early investor, does not have his ownership stake listed as he is no longer an active executive.

Based on DoorDash’s Series H share price, Xu’s holdings are valued at approximately $680 million, while his two co-founders each have holdings worth around $620 million. This represents a substantial return, but also highlights the dilution experienced by the founders given the extensive capital raised throughout the company’s lifespan (having four co-founders likely contributed to this as well).

Turning to the venture capitalists, let’s begin with Sequoia, an early investor in DoorDash. Crunchbase indicates Sequoia spearheaded the Series A and Series C rounds and also participated in later funding stages. The S-1 filing reveals Sequoia invested roughly $115 million in the Series D round (led by SoftBank’s Vision Fund) and an additional $50 million across Series E through H.

Currently, Sequoia owns approximately 18.2% of DoorDash, translating to a holding value of $2.38 billion based on the Series H share price. Roughly 40% of Sequoia’s stake is held within the firm’s fourteenth early-stage fund, known as a “holdco,” with the remainder distributed across various growth funds. This early-stage fund was valued at $553 million in 2013, as reported by Reuters, meaning the DoorDash IPO is poised to significantly enhance the fund’s overall performance.

Next, the SoftBank Vision Fund holds a 22.1% stake in DoorDash. The firm invested $280 million in Series D, $100 million in Series F, $250 million in Series G, and $50 million in Series H, for a total investment of $680 million. Its current holding is valued at $2.89 billion, resulting in a return of approximately 4.25x before the IPO.

Lastly, Singapore’s GIC owns 9.3% of DoorDash, with a current holding value of $1.22 billion. The firm invested around $155 million in DoorDash’s later growth rounds, achieving a particularly favorable multiple on invested capital (MOIC) due to its investments in the more affordable growth stages and reduced participation in more recent rounds.

A noteworthy graph illustrates DoorDash’s share price evolution over the past two-plus years. The price has risen dramatically from $4.79 in early March 2018 to $45.91 in June 2020—an increase of nearly 10x in just two years. This acceleration began before the onset of the coronavirus pandemic, potentially indicating the company was already demonstrating a viable operational model prior to COVID-19.

Finally, Kleiner Perkins contributed $7.6 million to the company’s last growth round in June. Kleiner led DoorDash’s Series B, but appeared to have limited involvement in the company’s growth investments in recent years.

The reason for their re-entry just before the IPO is unclear, but it is a noteworthy detail. As their stake is less than 5%, no further information was disclosed.

Related Posts

21-Year-Old Dropouts Raise $2M for Givefront, a Nonprofit Fintech

Monzo CEO Anil Pushed Out by Board Over IPO Timing

Mesa Shutters Mortgage-Rewarding Credit Card

Coinbase Resumes Onboarding in India, Fiat On-Ramp Planned for 2024

PhonePe Pincode App Shut Down: Walmart's E-commerce Strategy