tencent investment stays on game in 2020

Tencent, the prominent Chinese technology corporation responsible for WeChat and numerous successful video games, is widely recognized for its substantial investment activity. This proactive investment approach continued throughout 2020, even as economic conditions were impacted by the global pandemic.

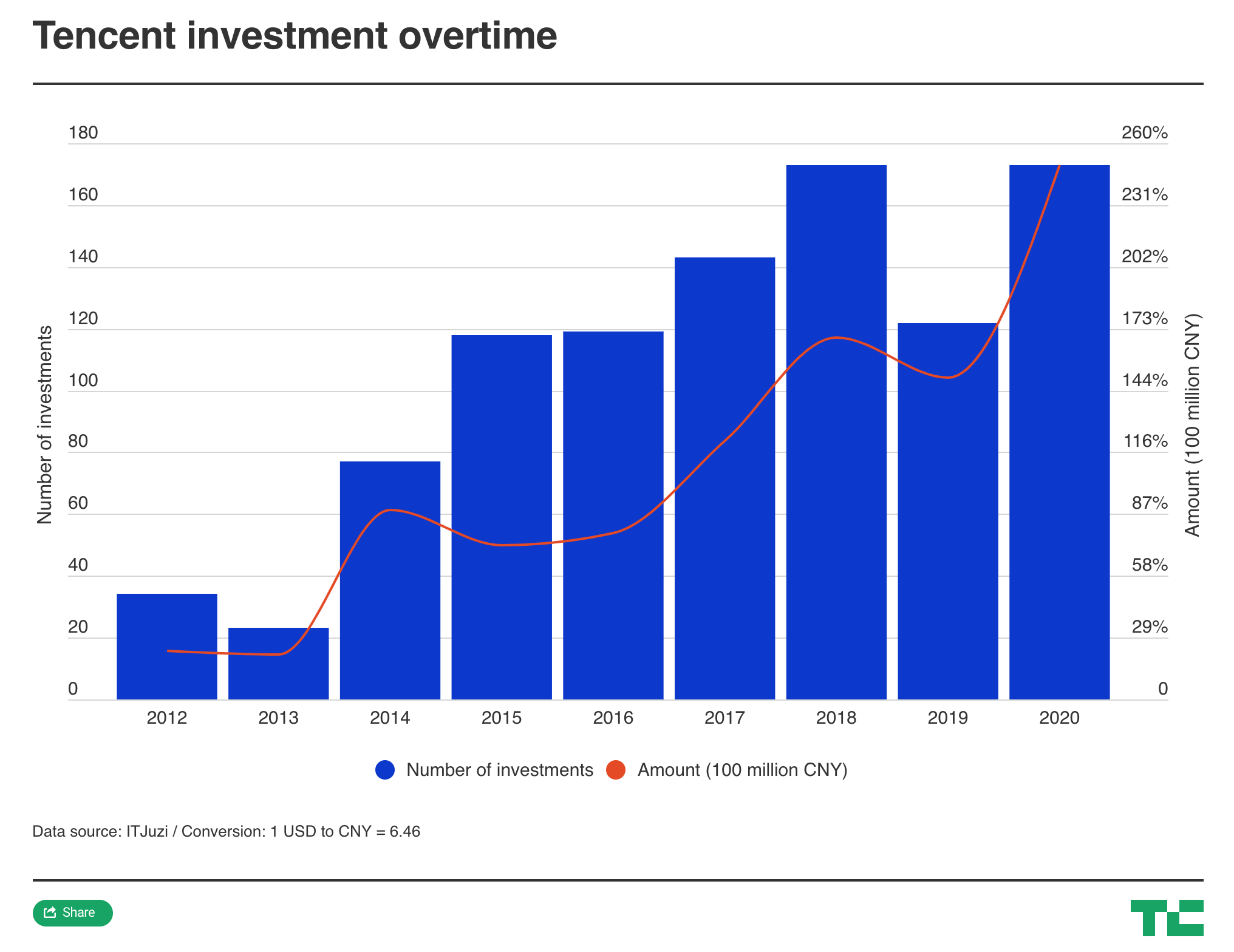

Throughout the year, the firm participated in over 170 funding events, totaling 249.5 million yuan (approximately $38 million), as reported by the Chinese startup database ITJuzi. This level of activity established 2020 as the most prolific year yet for Tencent’s investment division, which has consistently generated strong returns over the past decade.

By January 2020, over 70 companies within Tencent’s portfolio of 800 had achieved an initial public offering, and more than 160 had reached valuations exceeding $100 million, as stated by Martin Lau, Tencent’s president, during a meeting with its investees. This accomplishment positions Tencent among the leading venture capital firms worldwide.

Tencent initially created a dedicated investment and mergers & acquisitions department in 2008 and significantly increased its financing efforts around 2012. Data from ITJuzi indicates that since 2015, the company has been providing funding to more than 100 businesses annually.

The company traditionally maintains a degree of privacy regarding its investment endeavors, and the data compiled by organizations such as ITJuzi may not represent a complete picture. Tencent did not provide an immediate response to inquiries from TechCrunch concerning its 2020 investments; therefore, this report primarily relies on publicly available information and insights from informed sources.

B2B interest

Tencent has maintained a consistent investment approach – building a varied portfolio with an emphasis on digital entertainment – but has simultaneously been increasing its activity in sectors beyond its core gaming business. Specifically, the company has demonstrated growing attention towards enterprise services following its declaration of a B2B strategic shift in 2018, directing more resources toward areas like cloud computing, financial technology, and related fields. Data from ITJuzi indicates that the quantity of investments Tencent made in enterprise software increased from five in 2015 to 28 in 2020.

Corresponding with this new emphasis on enterprise solutions, Tencent has also expanded its involvement in fintech. ITJuzi data reveals that the company supported 18 and 15 fintech startups in 2019 and 2020, respectively, a significant increase compared to the four it backed in 2015. This gradual growth demonstrates the firm’s heightened interest in a sector that offers substantial profitability but also presents numerous regulatory challenges.

Within China, Tencent has consistently been a competitor to Ant Group, the financial technology arm of Alibaba, in attracting customers for services including payments, loans, wealth management, and insurance. The regulatory difficulties currently experienced by Ant Group are not limited to the Jack Ma-founded organization and will likely pose challenges to its competitors, including Tencent’s fintech divisions.

However, a source collaborating with Tencent’s international fintech operations informed TechCrunch that Tencent is “not nearly as assertive” as Ant Group in its efforts to solidify its standing within China’s financial landscape.

Fintech overseas

The company is also exercising caution with its international fintech ventures amidst current geopolitical circumstances. Currently, its focus remains largely on offering cross-border payment solutions for Chinese tourists traveling abroad, rather than directly targeting local populations.

“Significant attention is being paid to the activities of Tencent and Alibaba within the United States, which creates certain difficulties,” explained the CEO of a U.S.-based startup with Tencent backing, who requested anonymity.

However, through strategic investments, Tencent has gained valuable experience with international financial markets. The company made a single fintech investment outside of China in 2015. By 2020, this number had increased to eight, as indicated by publicly available data from Crunchbase.

A substantial number of Tencent’s external investments lack clear strategic alignment, and the company generally allows its portfolio companies to function with a high degree of independence. This approach led to criticism in 2018, with a widely circulated article titled “Tencent Has No Dream” accusing the company of prioritizing investment returns over product development and innovation. This hands-off strategy contrasts sharply with Alibaba’s practice of acquiring controlling interests in businesses and subsequently restructuring their leadership, as seen with Lazada.

Despite this, many of Tencent’s investments contribute to its overall business objectives, even if potential strategic benefits aren't explicitly highlighted in public announcements. Over time, Tencent has made numerous smaller investments in the U.S. and other Western nations. While immediate collaborative opportunities may not be apparent, Tencent frequently invites executives from these companies to China for knowledge sharing and mutual learning.

“Tencent’s primary motivation for these investments appears to be gaining insights into practices within the U.S. market and assessing their potential applicability in China,” stated the executive from the Tencent-backed startup.

“We currently have no plans for operations within China. However, Tencent is a highly respected brand, both in China and the U.S., and maintaining the possibility of future, more strategic partnerships with Tencent is beneficial.”

Tencent’s fintech investments outside of China may also support the company’s international gaming expansion, according to a fund manager based in Hong Kong. Tencent announced in 2019 its ambition to have half of its gaming users located outside of China.

“In Latin America and Southeast Asia, the primary obstacle for the gaming industry isn’t hardware, but rather payment solutions,” the fund manager shared with TechCrunch. “Naturally, localization and compatibility are also crucial factors.”