Robinhood is Now a Stonk - What Does it Mean?

Robinhood Stock Experiences Volatility and Trading Halt

Update: Trading in Robinhood shares was temporarily suspended due to significant price fluctuations. The company’s stock was paused at $65.60 on the Robinhood platform itself. However, Yahoo Finance reported a higher price of $77.03 for the company’s equity, representing a substantial increase of 64.59% for the day. The situation remains dynamic, with trading resuming after the initial halt.

Significant Price Surge in Premarket Trading

Shares of Robinhood, a consumer fintech company focused on investing, witnessed a considerable rise in value during premarket trading this morning. The recent activity mirrors the "stonk" phenomenon that previously impacted companies like GameStop and AMC. It is noteworthy that a large volume of GameStop and AMC trading occurred on the Robinhood platform during that earlier period.

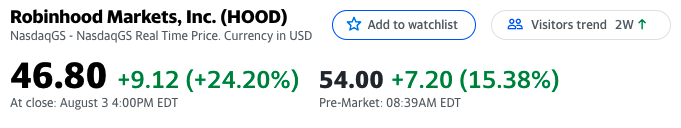

Here's a snapshot of the market data as of this morning, according to Yahoo Finance:

From IPO Low to Current Value

It is important to remember that Robinhood initially went public at $38 per share, the lower end of its projected range. The stock subsequently fell below its IPO price in early trading sessions. Currently, the stock is valued at $54 per share.

Unique IPO Structure and Retail Investor Participation

Robinhood’s initial public offering featured an unconventional approach. A portion of its equity was specifically reserved for purchase by its existing user base. Consequently, a greater number of retail investors likely held Robinhood stock at the beginning of its public trading compared to a traditional IPO.

A prevailing theory suggested that Robinhood’s initial trading performance was somewhat subdued because the early demand from retail investors was satisfied through this direct allocation. This potentially resulted in a more balanced supply and demand dynamic upon its market debut.

Analyzing the Current Market Dynamics

Conditions have shifted. Last week, an analyst assigned a $65 price target to the stock. Several other ratings are also available for consideration. However, the substantial price movement observed today appears to be another instance of the "stonk" phenomenon. The stock is exhibiting trading patterns similar to a short squeeze, despite some skepticism regarding the level of short interest in the company.

Recent Financial Reports and Company News

A review of Robinhood’s investor relations page reveals no recent news announcements. The company has not recently released earnings reports. Furthermore, its recent 606 filings, concerning Payment for Order Flow (PFOF) income, aligned with revenue expectations as previously outlined in its Q2 2021 preliminary results. While cryptocurrency trading may have contributed more than anticipated, no significant anomalies were detected.

The "Stonk" Phenomenon Continues

The current increase in Robinhood’s stock price appears to be self-perpetuating. Such occurrences are becoming increasingly common in the 2021 market landscape.

Implications of User-Based IPO Allocation

Notably, Robinhood’s decision to offer a portion of its IPO shares to its users did not prevent the stock from experiencing volatile trading. It demonstrates that a company can pursue an unconventional public offering strategy and still be subject to the forces of speculative trading. This highlights a new dynamic in the market.

Related Posts

Trump Media to Merge with Fusion Power Company TAE Technologies

Radiant Nuclear Secures $300M Funding for 1MW Reactor

Coursera and Udemy Merger: $2.5B Deal Announced

X Updates Terms, Countersues Over 'Twitter' Trademark

Slate EV Truck Reservations Top 150,000 Amidst Declining Interest