Building a Magical Neobank: One Woman's Vision

The Crucial Co-Founding Roles at Nubank

As previously discussed in the first part of this EC-1 series, David Velez identified two essential co-founding positions necessary for the initial development of Nubank. Specifically, he required a CTO to spearhead the technological aspects of the venture, given Velez’s own lack of formal engineering training.

This responsibility was ultimately assumed by Edward Wible, a computer science graduate from the United States whose professional experience was largely concentrated within the private equity sector. While Wible didn't possess extensive hands-on coding experience, he demonstrated attributes that Velez deemed paramount: a firm conviction in the product’s potential and an unwavering dedication to its realization.

The More Challenging Search

However, an even more critical role remained vacant – one proving significantly more difficult to define. This co-founder needed to possess a unique combination of attributes. They required deep understanding of the Brazilian market, local business acumen, and substantial banking expertise, all while embracing a customer-centric philosophy akin to that found in Silicon Valley.

Furthermore, this individual would be expected to work in São Paulo for a modest salary, operating from a small office with limited amenities, driven by the belief that their future equity stake would ultimately prove rewarding.

Cristina Junqueira: The Perfect Fit

Velez eventually found Cristina Junqueira, whose qualifications encompassed all of these requirements, and extended far beyond them.

Junqueira herself described her role with confidence, stating, “Someone once said I was the glue of the operation, and that someone else was the brains. And I said, ‘No, I’m the glue and the brains, and I bet my brain is even better than his.’”

Reimagining Banking in Brazil

Junqueira was instrumental in Nubank’s successful expansion into the Brazilian market. She also fundamentally challenged conventional perceptions of modern banking. Her inspiration stemmed from the Disney corporation, and her objective was to establish a bank with comparable levels of widespread appeal.

The ambition to create a bank as universally loved as Disney might seem fantastical.

Nubank’s success hinged on finding individuals who could not only execute a vision but also redefine the possibilities within the financial sector.

A Natural Inclination Towards Action

In contrast to her co-founders, Velez and Wible, Junqueira’s formative years were spent in Nubank’s native Brazil. Being the eldest of four daughters, she vividly remembers observing her parents – both practicing dentists – consistently and diligently managing their professional practice.

This dedication instilled a strong work ethic within her, alongside a sense of accountability. As the oldest child, she was compelled to mature rapidly and assume responsibilities at a young age. “I distinctly recall handling the monthly grocery shopping at the age of eleven,” she stated. “I experienced many adult responsibilities very early in life.”

Her academic pursuits led her to the Universidade de São Paulo, where she completed both her bachelor’s and master’s degrees in industrial engineering. Subsequently, she began her professional career at the São Paulo office of Boston Consulting Group (BCG).

Her academic pursuits led her to the Universidade de São Paulo, where she completed both her bachelor’s and master’s degrees in industrial engineering. Subsequently, she began her professional career at the São Paulo office of Boston Consulting Group (BCG).The work environment at BCG proved exceptionally demanding; she remembers dedicating six consecutive months to a single project without a single day of leave. “I informed my manager one day that I desperately needed a rest – that I was physically unable to continue – and consequently, I fashioned a makeshift bed from paper on the floor, which he allowed me to use for a two-hour nap,” she recounts. “My entire life has served as preparation for launching a startup.”

After her time at BCG, she pursued an MBA at Northwestern’s Kellogg School of Management in the U.S., returning to Brazil upon graduation. She then accepted positions at several financial institutions, including LuizaCred and Itaú Unibanco, a major Brazilian bank, providing her with a comprehensive understanding of the nation’s financial landscape.

Throughout her career, she consistently demonstrated a proactive approach. “I identify as a doer, first and foremost. While I recognize the importance of strategic discussions to ensure we remain on course, I am truly energized by witnessing ideas come to fruition – the act of accomplishing tasks is what genuinely motivates me,” Junqueira explained.

Throughout her career, she consistently demonstrated a proactive approach. “I identify as a doer, first and foremost. While I recognize the importance of strategic discussions to ensure we remain on course, I am truly energized by witnessing ideas come to fruition – the act of accomplishing tasks is what genuinely motivates me,” Junqueira explained.This “results-oriented” mindset ultimately prompted her departure from Itaú. While employed in their credit card division, she developed a presentation for her supervisor outlining a plan to enhance the customer experience while simultaneously reducing costs.

However, her manager dismissed the proposal, citing the bank’s established customer base and the lack of competitive alternatives. “He responded by saying, ‘There’s no need for that. We can simply add another fee to the customer to maintain profitability,’” she recalls. “I eventually became deeply frustrated, realizing that meaningful change was unlikely to occur within that organization.”

The Origins of Nubank and Alice

Junqueira had dedicated years to attempting industry reform from within established institutions. She describes a growing dissatisfaction with banks prioritizing product promotion over genuine customer improvement.

“I reached a point of frustration. My departure followed, without a clear path forward, but with the firm conviction that my efforts should be directed towards simplifying and enhancing people’s lives, rather than complicating them,” she explains.

Her connection with Velez occurred through a shared acquaintance, leading to the inception of Nubank. “Upon meeting David and discussing the concept of Nubank, I immediately recognized its potential.” She committed to the venture without hesitation.

Velez viewed Junqueira as possessing the precise experience and character traits essential for a third co-founder. “I understood that Nubank’s success hinged on a diverse founding team with varied backgrounds. As a non-Brazilian initiating a bank in Brazil, partnering with a local expert possessing in-depth industry knowledge, coupled with a strong desire for transformation, was crucial. Cris embodied all these qualities.”

Junqueira formally joined as a co-founder during the company’s intensive eight-month period leading up to the launch of its initial product. Subsequently, she accompanied Velez to the Bay Area to secure $14.3 million in Series A funding from investors. This occurred while she was several months pregnant.

Junqueira formally joined as a co-founder during the company’s intensive eight-month period leading up to the launch of its initial product. Subsequently, she accompanied Velez to the Bay Area to secure $14.3 million in Series A funding from investors. This occurred while she was several months pregnant.“My primary objective was to divert investors’ attention from my pregnancy and focus their consideration on our business proposal.” She acknowledges that many investors were taken aback by a pregnant entrepreneur seeking investment for a Latin American startup.

Their presentation ultimately proved successful, and due to the pressing timeline, Velez presented Junqueira with the funding agreements for signature while she was hospitalized for the birth of her first child, Alice.

“Currently, we observe significant venture capital investment in Latin America and a rapidly expanding ecosystem. However, at that time, the region was largely uncharted territory for many investors. We represented the initial Latin American investment for numerous funds that continue to invest in the region today, a source of considerable pride for us,” she reflects.

Both Nubank and Alice came into the world in May 2014. “I often remark that Alice and Nubank are twins,” Junqueira states.

Creating a Banking Experience Inspired by Disney

Junqueira harbors a significant admiration for Disney. However, it wasn't until a recent conversation that the extent of her fondness for the magical kingdom became fully apparent.

Due to pandemic-related travel restrictions preventing a trip to Brazil, our discussion with Junqueira took place via Zoom. From her home office in São Paulo, she generously offered a virtual tour of her living space. The apartment, while tastefully furnished, was adorned with Disney memorabilia, including a roughly two-foot-tall Cinderella Castle constructed from Lego bricks and Minnie Mouse-shaped, sequined pillows in baby pink.

This tour, coupled with our subsequent dialogue, revealed that Junqueira’s encounters with Disney were profoundly impactful and memorable. Notably, she chose to name both of her daughters after Disney princesses – Alice, inspired by the protagonist of “Alice in Wonderland,” and Bella, after Belle from “Beauty and the Beast.”

Junqueira is acutely aware of her passion for Disney, and it was this very enthusiasm she aimed to replicate within Nubank’s brand identity and customer interactions. To realize this vision alongside Velez, they selected a vibrant color scheme for Nubank, designed to differentiate it from traditional banking institutions. They also prioritized rapid decision-making regarding credit card offerings, and Junqueira played a key role in expanding financial access to millions of previously unbanked Brazilians.

Considering the often-unfavorable customer service historically provided by established banks in Brazil, Nubank’s demonstrably open and transparent approach has cultivated a substantial and devoted following. (Whether Nubank can truly rival Mickey Mouse remains to be seen – a “Nuworld” or “Nuland” is unlikely to materialize in the near future.)

“My consistent focus has been on providing exceptional service to our customers, and this is an approach I directly adopted from Disney,” Junqueira explains.

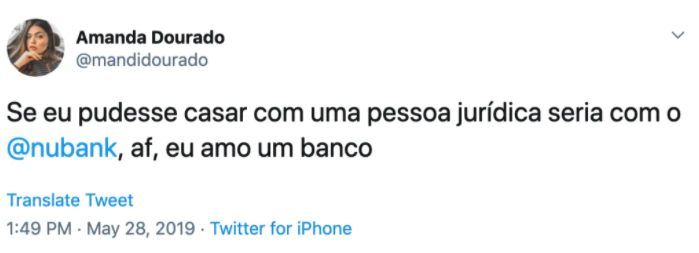

Her efforts have demonstrably succeeded. Nubank now boasts a customer base that is, to say the least, exceptionally enthusiastic. The company enjoys such popularity that it’s common to find social media posts, including tweets and Instagram updates, where customers jokingly propose marriage to Nubank.

One such tweet reads: “If I could marry a company, I’d marry @nubank, ugh, I love a bank.”

Consider this: individuals are publicly expressing affection for a bank.

A Multifaceted Leader at Nubank

From her initial days with Nubank, Junqueira has consistently demonstrated a proactive and solution-oriented approach. This willingness to tackle any necessary task has resulted in a fluid and evolving official title within the organization. She now identifies simply as a co-founder, allowing her duties to adapt to the company’s changing priorities.

“Initially, Ed [Wible] oversaw the development team, while I managed a broad spectrum of responsibilities – encompassing everything from wireframing to engaging with the Central Bank,” she explained.

This comprehensive involvement continued throughout Nubank’s early years. Junqueira spearheaded numerous teams, including those focused on legal affairs, operations, business development, corporate strategy, mergers and acquisitions, real estate and facilities, marketing and branding, as well as public relations and communications.

Currently, she describes her role as leading teams where her expertise surpasses that of existing personnel. “I essentially handle all remaining tasks,” she states. “Presently, my focus is on branding, marketing, social media, content creation, communications, CRM, and consumer insights – encompassing all facets of marketing.” She acknowledges there are likely additional responsibilities she hasn’t recalled.

Her position remains dynamic. On June 2nd, the company announced the appointment of Arturo Nunez as its first chief marketing officer. Nunez previously led marketing efforts for Apple Latin America and held positions with Nike and the NBA.

Although Nunez’s arrival may alleviate some of Junqueira’s workload, she anticipates maintaining a diverse range of responsibilities. This aligns perfectly with her self-described nature as a proactive individual and generalist, driven by a vision of establishing Nubank as the leading banking experience in Brazil and throughout Latin America.

Junqueira’s contributions were pivotal in launching Nubank, and as will be detailed in the third installment of this EC-1 series, the company’s product strategy, launch, and scaling proved crucial to its sustained success.

Nubank EC-1 Contents

- Introduction

- Part 1: The Beginning

- Part 2: The Co-founder Relationship

- Part 3: Growth and Launch

- Part 4: Expansion and Future Outlook

Explore additional EC-1 analyses on Extra Crunch.

Related Posts

Coinbase Resumes Onboarding in India, Fiat On-Ramp Planned for 2024

PhonePe Pincode App Shut Down: Walmart's E-commerce Strategy

Nexus Venture Partners Allocates $350M to India Startups | AI Funding

Fintech Firm Marquis Alerts Banks of Data Breach | Ransomware Attack

Kalshi Raises $1B at $11B Valuation - Doubling Value Quickly