Loop Auto Insurance: Fairer Rates & Transparent Pricing

Traditional vehicle insurance policies from established companies often contain inherent biases in their pricing structures. These policies frequently rely on factors like credit history, earnings, relationship status, and educational attainment to determine premiums, ultimately resulting in higher costs and reduced coverage for those with limited financial resources.

Loop, a company established by John Henry and Carey Anne Nadeau, aims to introduce a different approach designed to be fair for everyone.

“Systemic bias is deeply embedded within financial services and the organizations that sustain and amplify it,” explained Nadeau, who previously contributed to research at the Brookings Institute and pursued studies at MIT focusing on economic opportunity. “While banking receives considerable attention, insurance is often an overlooked component within the broader landscape of financial services.”

How to rewrite the rules

Loop operates as a managing general agent (MGA), enabling it to function both as an insurance broker and a provider within the insurance industry. It focuses on marketing, customer acquisition, and service, rather than simply offering a product built on top of an established insurance company. This startup is also a certified B corp, demonstrating a commitment to balancing profitability with environmental and social responsibility.

The company aims to redefine auto insurance by utilizing two primary factors to determine and apply insurance rates: the condition of roadways and driver conduct. Loop establishes rates based on actual vehicle usage, contrasting with traditional providers who often rely on demographic information.

Loop is exclusively available as a mobile application and features direct integration with insurance carriers.

Upon downloading the app, users receive a personalized quote based on their geographic location. The core of this functionality lies in Loop’s technology: a database containing information on over 100 million car accidents across 27 states. This data allows Loop to generate a quote tailored to a user’s location. Henry, a co-founder of Harlem Capital, characterizes Loop’s data as providing “an exceptional understanding of crashes that have occurred on each specific road.”

The startup also incorporates data related to traffic levels, road infrastructure, and weather conditions when setting rates. Its artificial intelligence capabilities could potentially guide drivers away from high-risk roads or reward safe driving habits with reduced premiums.

A second key component of the business relies on telematics technology, which allows Loop to monitor a driver’s movements and driving patterns in real-time. While traditional insurance companies may offer lower rates based on a clean accident record, Loop uses data to both initially set the rate and subsequently adjust it based on driving behavior.

A second key component of the business relies on telematics technology, which allows Loop to monitor a driver’s movements and driving patterns in real-time. While traditional insurance companies may offer lower rates based on a clean accident record, Loop uses data to both initially set the rate and subsequently adjust it based on driving behavior.The exchange of data for greater pricing flexibility may be a concern for some, but the founders believe their target demographic – primarily millennials and Generation Z – will find the model appealing due to its promise of fairer pricing. Loop earns a gross commission on each insurance policy it sells.

Loop also cites Ohio-based Root Insurance as an example of increasing consumer acceptance of location data sharing. This car insurance startup successfully completed an initial public offering (IPO), which was viewed as a positive outcome for a rapidly growing technology company based in the Midwest. Root also utilizes driver performance metrics and telematics technology to assess risk.

“They employ telematics but still largely depend on traditional insurance methods,” explains Henry. “We are essentially replacing that with our own AI-driven system.”

While Root is a prominent competitor, usage-based pricing has been a growing trend in the insurance sector for over ten years, manifesting in various forms. The insurtech market has experienced significant activity recently, including MetroMile’s SPAC merger, Lemonade’s IPO, and Marshmallow, a U.K.-based auto insurance startup, which was last valued at $130 million.

The co-founders are confident that their technology is sufficiently unique to succeed in this competitive landscape.

A racial reckoning and a tweet

The concept for this new company originated in July 2020, following the death of George Floyd, a Black man, at the hands of law enforcement. Worldwide demonstrations followed, advocating for reform and resolutions to address ingrained racial inequalities. Venture capital firms quickly moved to support entrepreneurs of color, and Henry identified an unmet need for solutions genuinely dedicated to positive change.

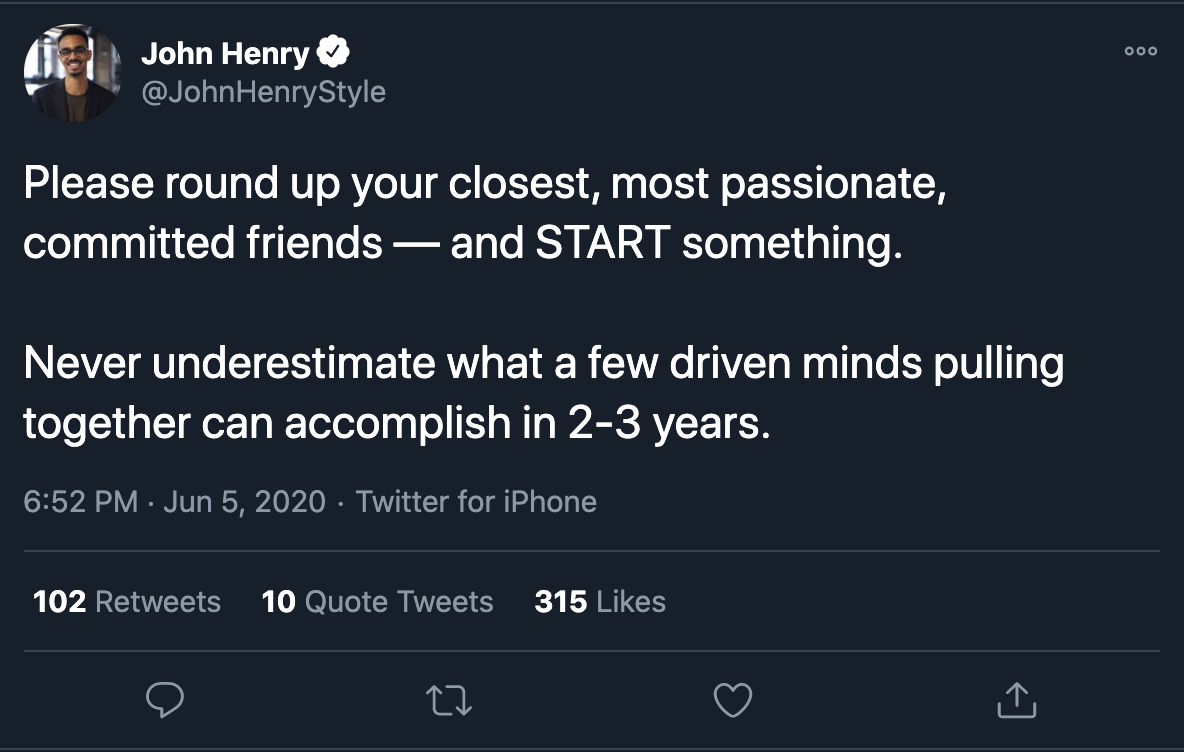

Henry expressed his initial thoughts in a tweet:

“I realized that the changes we desire wouldn’t simply happen on their own,” Henry explained. “It requires a deliberate effort to address systemic problems.” Knowing Nadeau’s background in transportation and mobility, the pair ultimately decided to pursue a significant undertaking.

Despite acknowledging the challenge, the founders have attracted investors who believe Loop has the potential to become a substantial enterprise. The company reports to TechCrunch that it has secured $3.25 million in seed funding, spearheaded by Freestyle VC, with contributions from Blue Fog Capital, Fontinalis Capital Partners, Concrete Rose, Uprising Ventures and Backstage Capital. Several angel investors also participated, including Kristen Dickey, Steve Schlafman, Songe LaRon, Craig J. Lewis, Gerard Adams and Joshua Dorkin.

Despite acknowledging the challenge, the founders have attracted investors who believe Loop has the potential to become a substantial enterprise. The company reports to TechCrunch that it has secured $3.25 million in seed funding, spearheaded by Freestyle VC, with contributions from Blue Fog Capital, Fontinalis Capital Partners, Concrete Rose, Uprising Ventures and Backstage Capital. Several angel investors also participated, including Kristen Dickey, Steve Schlafman, Songe LaRon, Craig J. Lewis, Gerard Adams and Joshua Dorkin.These funds will be allocated to recruitment and the development of the company’s data science infrastructure. While not yet available to the public, Loop is preparing to launch in Ohio, Illinois, Pennsylvania and New York, contingent upon receiving the necessary regulatory approvals.

The team engaged with 77 different investors, with 25% of those being female investors, to obtain the capital needed to launch Loop.

“The process proved more challenging than anticipated,” Henry stated. “From the outset, we aimed to secure a larger seed round to demonstrate to the market our intention for substantial growth.”

Loop successfully completed the funding round and achieved its target valuation. What ultimately convinced investors to support a company aiming to disrupt a $256 billion industry with $3 million in seed financing?

The company’s core purpose, according to Henry.

“I’m genuinely moved by this,” he said, “because our mission will unlock opportunities that profit alone cannot.”

Related Posts

21-Year-Old Dropouts Raise $2M for Givefront, a Nonprofit Fintech

Monzo CEO Anil Pushed Out by Board Over IPO Timing

Mesa Shutters Mortgage-Rewarding Credit Card

Coinbase Resumes Onboarding in India, Fiat On-Ramp Planned for 2024

PhonePe Pincode App Shut Down: Walmart's E-commerce Strategy