Is Slack Overpriced? Salesforce Acquisition Speculation

Though the Exchange is officially on hiatus today, we’re proceeding with discussion as there are interesting developments in the startup and financial sectors worth covering. Therefore, let's delve into Slack’s recent valuation and analyze what the market indicates regarding the true worth of this established SaaS business.

The Exchange provides insights into startups, markets, and finance. Access it daily on Extra Crunch, or subscribe to The Exchange newsletter each Saturday.

As reported on Wednesday, Salesforce is evaluating the possibility of acquiring Slack, a potential move with both advantages and uncertainties.

The potential benefits could involve integrating Slack’s strong presence within the startup community into Salesforce, and extending Salesforce’s extensive enterprise capabilities to Slack’s user base. However, it remains unclear how Slack would align with Salesforce’s core CRM and platform strategy; Salesforce’s own similar product, Chatter, has not achieved market dominance in the decade following its 2009 debut (as covered by TechCrunch at its launch), raising some doubts about Slack’s future within Salesforce.

Despite these uncertainties, Slack’s shareholders reacted positively to the prospect of a Salesforce acquisition, while investors in Salesforce saw a nearly $20 decrease in the company’s share price, potentially concerned about the same factors that excited Slack’s owners.

This leads to the question of valuation: What is Slack actually worth? This is a compelling question both from a theoretical perspective and for understanding the present state of the software mergers and acquisitions landscape – how much capital is required to remove a significant player from the software market?

Let’s examine what we can glean from Slack’s valuation before and after this news emerged.

Determining its Value

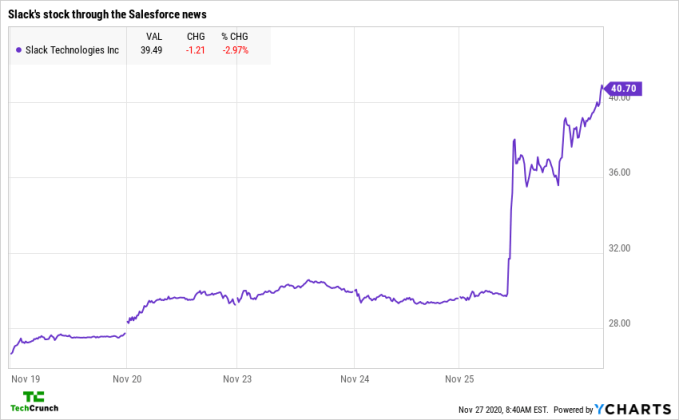

The following provides a comparison of Slack’s valuation prior to and following reports concerning Salesforce, illustrating the substantial impact the news coverage generated:

In simpler terms, Slack’s value stood at just below $30 per share prior to the Salesforce announcement, and now rests at just above $40 following the market’s reaction. More specifically, according to data from YCharts, Slack’s market capitalization was $16.88 billion before the news and has risen to $22.58 billion.

To determine if these prices are justified, let’s examine additional data (sourced from YCharts):

- Slack’s revenue over the trailing twelve months: $768.14 million.

- Slack’s revenue from the most recent quarter: $215.86 million (projected annual revenue: $863.44 million).

- Slack’s estimated revenue for the current fiscal year: $877.25 million (ending January 31, 2020).

Based on this information, we can calculate the relevant revenue multiples for Slack’s valuation before the Salesforce news:

- Slack’s revenue multiple based on trailing twelve months’ revenue: 22x.

- Slack’s revenue multiple based on last quarter’s annualized run rate: 19.5x.

- Slack’s revenue multiple based on current fiscal year revenue estimate: 19.2x.

And, reflecting the company’s updated valuation:

- Slack’s revenue multiple based on trailing twelve months’ revenue: 29.4x.

- Slack’s revenue multiple based on last quarter’s annualized run rate: 26.2x.

- Slack’s revenue multiple based on current fiscal year revenue estimate: 25.7x.

Initially, I anticipated Slack would appear overvalued at its new valuation. This expectation stemmed from the belief that the market was assessing the price Salesforce might be compelled to pay for an acquisition, rather than Slack’s standalone value. A substantial premium was expected.

However, after analyzing comparable companies within the Bessemer cloud index, Slack’s new valuation doesn’t appear excessively high. For instance, Twilio is valued similarly on an annualized basis, exhibiting comparable growth and efficiency.1 Furthermore, Twilio’s gross margins are lower than Slack’s, potentially suggesting that the workplace chat application is currently undervalued.

Avalara also presents similar multiples, but with comparatively weaker performance metrics. Other companies within the index sometimes suggest Slack isn’t inexpensive, but nothing indicates that Slack is currently expensive given prevailing market conditions.

Slack’s previous valuation was influenced by factors beyond simple revenue calculations. Microsoft has actively competed with Slack in recent years, with some success. The market anticipates this competition will be costly and prolonged; perhaps with Salesforce’s backing, Slack would be better positioned to challenge Microsoft?

This perspective helps explain the company’s valuation increase, why its new valuation seems reasonable considering its core metrics, and why the company may have been somewhat undervalued before the acquisition discussions became public.

Therefore, assuming Salesforce is genuinely interested and a successful integration is feasible, these developments are noteworthy. It’s a remarkable situation!

- At this point, we’ve transitioned to enterprise value multiples, as that’s the standard used by Bessemer. We initially calculated multiples using market capitalization because that data was readily available; obtaining a current enterprise valuation for Slack while adhering to a single data source proved challenging. Therefore, we’ve shifted from the latter to the former. This doesn’t affect our argument, but I wanted to clarify in case you were paying close attention and thought there was an error. Best!