Investors Favor Software Stocks Over Life Sciences

The TechCrunch Exchange: Startups, Markets, and IPOs

Welcome to The TechCrunch Exchange, a weekly newsletter focused on startups and market trends. This edition is derived from the daily Extra Crunch column, but is freely available for your weekend review. Interested in receiving it directly each Saturday? Sign up here.

Let's delve into discussions surrounding finances, emerging companies, and potential initial public offerings.

SaaS Valuations in a Volatile Market

Despite recent market fluctuations, software companies have maintained impressive valuations. A recent analysis by Battery Ventures explored the reasons behind this trend, and identified areas where valuations might be inflated.

The report suggests that the mid-market segment within the SaaS landscape may be experiencing the most significant valuation increases. This is a key consideration for startups experiencing a slowdown in growth.

However, today we will shift focus and present historical data demonstrating the favorable conditions currently enjoyed by both modern software startups and their more established counterparts.

Historical Valuation Comparisons

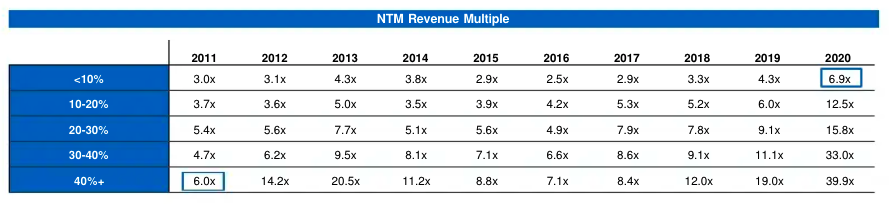

As illustrated in the image, contemporary SaaS companies experiencing less than 10% annual growth are currently valued at approximately 6.9 times their projected next-year revenue.

For context, in 2011, SaaS businesses achieving 40% or greater growth were valued at 6.0 times their anticipated revenue. This represents a significant shift in market dynamics.

The Evolving Definition of ARR

During a discussion with Battery investor Brandon Gleklen, the topic of Annual Recurring Revenue (ARR) arose. He suggested that strict adherence to the traditional ARR definition is becoming less critical.

With the increasing adoption of consumption-based pricing models, Gleklen emphasized that the key metric is the retention and growth of software revenues over the long term, regardless of how those revenues are categorized.

This leads us to our next area of exploration.

Consumption-Based vs. SaaS Pricing Models

Recent earnings calls with publicly traded software firms have consistently highlighted a key debate: the merits of consumption pricing versus traditional SaaS pricing. Data suggests companies utilizing consumption-based models are currently achieving higher valuation multiples, largely due to superior customer retention rates.

However, the situation is more nuanced than simple valuation differences. A discussion with Joshua Bixby, CEO of Fastly, revealed a crucial distinction regarding market preferences for these pricing structures.

Customer Size and Pricing Preference

Bixby explained that Fastly observes a trend where larger enterprises favor consumption-based pricing. This preference stems from their capacity to absorb billing fluctuations and a desire for costs directly correlated with revenue generation.

Conversely, smaller customers often demonstrate a preference for the predictability of traditional SaaS billing. The fixed nature of SaaS pricing provides budgetary certainty that is particularly valuable to these businesses.

This observation was further explored with Kyle Poyar of Open View Partners, who has been actively analyzing this trend. He pointed out that, in certain scenarios, the opposite can occur.

Variably priced offerings can attract smaller companies by enabling developers to evaluate the product without substantial upfront financial commitment. This allows for risk-free experimentation and proof-of-concept testing.

Evolving Market Dynamics

It appears the software market is gravitating towards SaaS pricing for smaller customers who have a clear and defined need. However, consumption pricing gains traction when initial experimentation and flexible usage are prioritized.

Larger organizations, with revenue closely tied to their software expenditure, also lean towards consumption-based models. This alignment ensures cost scales proportionally with business performance.

The shift in SaaS pricing strategies will likely be gradual and incomplete. Nevertheless, it’s a topic receiving significant attention from industry leaders.

Appian CEO Matt Calkins advocates for a pricing approach where costs consistently remain below the value delivered to the customer. While hesitant to elaborate on specific models, he expressed dissatisfaction with current pricing practices.

Calkins aims to establish pricing that more accurately reflects the value received by each customer. This pursuit of a better value proxy is driving innovation in pricing strategies.

Strategic Considerations for Startups

For startups, ignoring this evolving conversation is a significant oversight. Further analysis is forthcoming, including insights from an interview with the CEO of BigCommerce.

BigCommerce is strategically prioritizing SaaS over the more consumption-driven approach adopted by Shopify, highlighting the diverse paths to success in the software market.

- Consumption pricing ties costs to actual usage.

- SaaS pricing offers predictable, fixed fees.

- Customer size significantly influences pricing preference.

Next Insurance and the Evolving Market Landscape

Next Insurance has recently completed the acquisition of AP Intego. This strategic move will facilitate integration with a range of payroll providers, benefiting the digitally-focused small and medium-sized business (SMB) insurance provider.

Readers may recognize Next Insurance, as its expansion has been covered by TechCrunch on several occasions. For instance, the company achieved a doubling of its premium run rate to $200 million in the year 2020.

The acquisition of AP Intego adds $185.1 million in active premium to Next Insurance’s portfolio. This signifies substantial growth for the neo-insurance provider in 2021, independent of its inherent organic development.

However, alongside the Next Insurance deal and the anticipated Hippo SPAC, the insurtech sector has experienced a cooling in public market enthusiasm.

Shares of publicly traded neo-insurance companies, including Root, Lemonade, and MetroMile, have seen considerable declines in value over recent weeks. Consequently, the potential exit strategies for companies like Next and Hippo – private insurtech startups backed by significant capital and experiencing rapid premium growth – are becoming less favorable.

Hippo has opted to enter the public market through a SPAC. It is unlikely, however, that Next Insurance will accelerate its own plans for an IPO until market conditions stabilize.

A pressing need for immediate public funding is not apparent, as Next Insurance secured $250 million in funding as recently as September of the previous year.

Implications of Market Shifts

- The insurtech market is undergoing a period of recalibration.

- Acquisitions, like Next Insurance’s purchase of AP Intego, are becoming increasingly important for growth.

- The SPAC route to market, while still viable, is facing increased scrutiny.

- Private insurtech companies with strong funding positions have greater flexibility in timing their public debuts.

Next Insurance’s strategic acquisitions and robust financial standing position it well to navigate these changing dynamics within the insurtech industry.

Assorted Updates

Further developments are noted. Sisense, having reached a $100 million Annual Recurring Revenue (ARR), has appointed a new Chief Financial Officer.

Consequently, an Initial Public Offering (IPO) is anticipated within the coming four to five fiscal quarters.

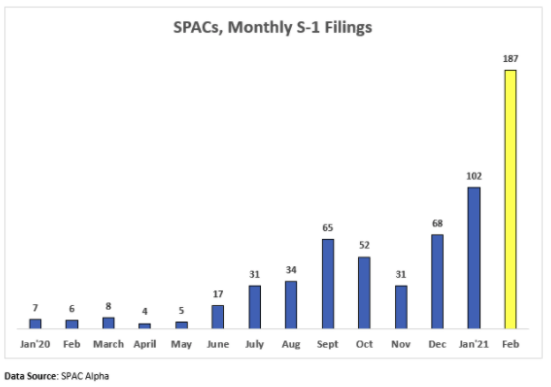

The subsequent chart is sourced from Deena Shakir of Lux Capital, originally appearing on Nasdaq and then shared by SPAC Alpha:

Reported by Alex.

Early Stage is a leading event providing practical guidance for both startup founders and investors. Attendees will gain insights directly from successful entrepreneurs and venture capitalists regarding business development, fundraising, and portfolio management.

Event Focus

The event comprehensively addresses all facets of building a company. Topics include fundraising, recruiting, sales, achieving product-market fit, PR, marketing, and brand building.

Each session is designed to encourage participation, with dedicated time allocated for questions and open discussion from the audience.

- Key Benefits: Direct learning from industry leaders.

- Interactive Format: Ample opportunity for audience engagement.

- Comprehensive Coverage: Addresses all critical aspects of startup growth.

Related Posts

Trump Media to Merge with Fusion Power Company TAE Technologies

Radiant Nuclear Secures $300M Funding for 1MW Reactor

Coursera and Udemy Merger: $2.5B Deal Announced

X Updates Terms, Countersues Over 'Twitter' Trademark

Slate EV Truck Reservations Top 150,000 Amidst Declining Interest