Google Antitrust Lawsuit: Investors Unfazed

It doesn't appear that investors are expressing worry over the Department of Justice’s antitrust lawsuit against Google, which was filed earlier today.

Some observers consider the lawsuit to be strategically timed close to the election, and it represents one component of a broader effort to reshape the technology sector, an industry that has significantly increased its wealth and influence in recent years. As reported by The Wall Street Journal, technology firms currently account for almost 40% of the S&P 500’s total value, surpassing the 37% share observed during the peak of the dot-com boom in 1999.

Concurrently, the overall success of the technology industry has resulted in substantial gains for its leading companies. Alphabet, Microsoft, Amazon, and Apple each have market valuations exceeding $1 trillion, establishing them as exceptionally valuable businesses even during a period of economic slowdown.

These market capitalizations do not currently show indications of being at risk.

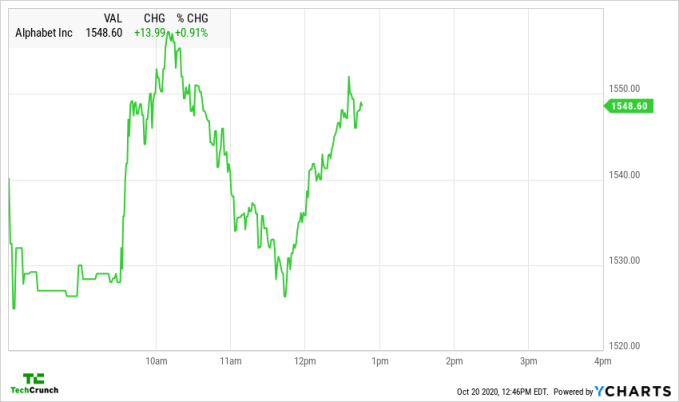

During regular trading hours this afternoon, the tech-focused Nasdaq Composite index has increased by 0.86%, and Alphabet’s stock has risen by 0.91%, mirroring the general market trend. Alphabet shares experienced an initial increase in value this morning before briefly retracting, but have since rebounded to slightly outperform the market.

Investor sentiment concerning Google’s potential antitrust-related liabilities may evolve over time. The Department of Justice’s lawsuit is not the sole legal challenge currently facing the search engine company. However, that shift in reaction is not occurring at this moment.