Hummingbird Secures $30M to Revolutionize AML Investigations with Design Thinking

Hummingbird Secures $30 Million in Series B Funding

Hummingbird, a provider of anti-money laundering (AML) software solutions for banks and financial technology companies, has announced the successful completion of a $30 million Series B funding round. The investment was spearheaded by Battery Ventures, a new investor in the company.

Investment Details and Future Plans

Existing investors, including Flourish and Homebrew, also participated in this funding round, alongside FinVC and William Hockey, the co-founder of Plaid.

This latest round brings the total funding raised by Hummingbird to $41.8 million, following its $8.2 million Series A round last year. The company intends to utilize these funds to bolster its team, currently at 35 employees. Specifically, expansion will focus on customer success, engineering, and product design, as stated by CEO Joe Robinson in a recent interview.

Company Background and Founding Team

The core team at Hummingbird comprises seasoned professionals from the fintech sector. Approximately half of the team members previously worked at Block (formerly Square), while the remaining half have experience with Circle, a blockchain payments firm.

Robinson, having previously led risk and data science initiatives at Circle for around two years, identified significant challenges faced by compliance professionals. These challenges contribute to the remarkably low success rate – less than 1% – of global anti-money laundering efforts.

Addressing Challenges in Financial Crime Investigation

“A wealth of data sources, risk indicators, and algorithms are available, offering substantial potential. However, integrating these elements effectively for investigations proves exceptionally difficult,” Robinson explained. “Currently, much of the necessary work is performed using rudimentary formats across numerous, disconnected systems.”

Platform Capabilities and Client Base

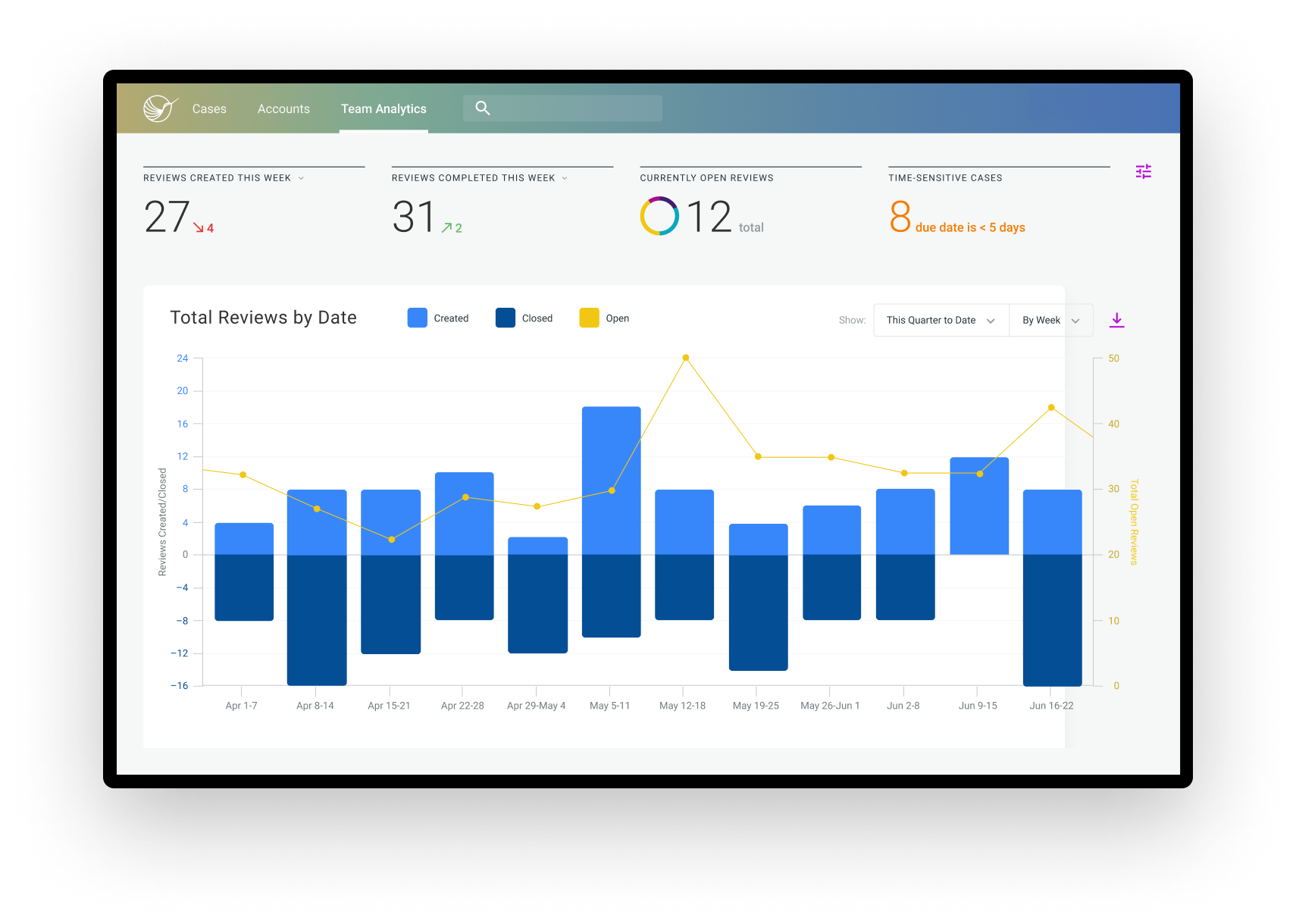

Financial crime investigators often manage between 100 and 200 cases each week. Recognizing this demand, Hummingbird developed a specialized Customer Relationship Management (CRM) system tailored for compliance and risk teams. This platform consolidates disparate data sets into a unified view, enabling more efficient handling of high case volumes.

Hummingbird’s current clientele includes prominent companies such as Stripe, Coinbase, and Evolve Bank & Trust. While the company has not disclosed the total number of clients served, it maintains a presence in seven countries and also supports e-commerce businesses like Etsy.

Global Expansion and Product Development

The company is planning to launch its services in the U.K. in early next year. Further expansion is anticipated into Europe and various regions throughout Asia, according to Robinson.

A key focus for the company’s future development is continuous improvement of its product design.

“We believe that the area of financial crime compliance is significantly underserved in terms of thoughtful design. Our goal is to be the first company to prioritize and deliver exceptional design thinking to this critical space,” Robinson stated.

Investor Perspective

Michael Brown of Battery Ventures, who has previously invested in fintech companies like MX Technologies, AuditBoard, and Next Insurance, led the investment in Hummingbird.

“Hummingbird stands out as the sole cloud-based provider concentrating on a comprehensive workflow platform for risk and compliance professionals – the frontline defenders against financial crime,” Brown commented. “While numerous startups offer specialized products within the broader fraud, KYC, and AML landscape, none are attempting to establish ownership of the workflow layer and connect these fragmented systems.”

Image Credits: Hummingbird

Image Credits: HummingbirdRelated Posts

21-Year-Old Dropouts Raise $2M for Givefront, a Nonprofit Fintech

Monzo CEO Anil Pushed Out by Board Over IPO Timing

Mesa Shutters Mortgage-Rewarding Credit Card

Coinbase Resumes Onboarding in India, Fiat On-Ramp Planned for 2024

PhonePe Pincode App Shut Down: Walmart's E-commerce Strategy