how vcs and founders see 2021 differently

Greetings and welcome to The TechCrunch Exchange, your weekly source for insights into the startup world and market trends. This newsletter is inspired by the daily insights featured on Extra Crunch, but is available to all and designed for your weekend enjoyment. Subscribe here to receive it directly in your inbox each Saturday morning.

Are you prepared? We’ll be discussing financial matters, emerging startups, and intriguing possibilities surrounding initial public offerings.

This week’s newsletter features a revised structure, concentrating on broader topics and recent developments rather than a collection of separate segments. This change was necessary due to the volume of information we wanted to share. If you preferred the previous format, we will return to it next week.

Our focus today includes an examination of Coinbase’s expansion, how Juked.gg utilized equity crowdfunding, some observations regarding a16z’s media strategy, an update on Talkspace’s SPAC deal, venture capital and founder forecasts for 2021, and a discussion on optimal locations for launching a new business.

Does that sound appealing? Let’s begin!

Coinbase Experiences Deposit Growth Leading Up to IPO

We’ve gained insight into the rapid expansion of deposits at the American cryptocurrency platform Coinbase, thanks to Kazim Rizvi from Drop, whose company Cardify tracks consumer spending patterns. With Coinbase having submitted its intention to become a publicly traded company, and anticipation building for the release of its S-1 filing, we were pleased to receive an indication of the increasing consumer engagement with the assets it facilitates the purchase of.

The platform is experiencing substantial growth. Utilizing the first week of January 2019 as a starting point, deposits to and withdrawals from Coinbase increased more than twelvefold by the final week of December 2020. This represents remarkable expansion, and while the data exhibits some fluctuation—and should be considered indicative rather than precise—its week-over-week trends highlight the potential strong performance of companies like Coinbase as Bitcoin’s popularity surges, driving increased trading activity and consumer interest.

Cardify’s data also reveals a significant increase in new customer acquisition at Coinbase during the same timeframe, with deposit growth correlating with the price of Bitcoin. Given Bitcoin recently surpassing the $30,000 threshold—a considerable increase compared to previous quarters—these price increases likely contributed to a strong fourth quarter of 2020 for Coinbase and may position it for an exceptionally successful first quarter of 2021.

Cardify’s data also reveals a significant increase in new customer acquisition at Coinbase during the same timeframe, with deposit growth correlating with the price of Bitcoin. Given Bitcoin recently surpassing the $30,000 threshold—a considerable increase compared to previous quarters—these price increases likely contributed to a strong fourth quarter of 2020 for Coinbase and may position it for an exceptionally successful first quarter of 2021.Our enthusiasm for the Coinbase S-1 filing was already high, but this data set has increased our excitement even further.

Equity crowdfunding secures seven-figure investment for esports content platform

Competitive gaming has become incredibly popular, and the market demonstrates its value through significant time, attention, and financial investment. Whether one personally agrees with its appeal is secondary to its established position within the entertainment landscape.

Despite the rapid growth of esports leagues and games, the industry currently lacks a centralized resource. This results in a fragmented environment, unlike the role ESPN fulfills for traditional sports.

Fortunately, Juked.gg recently obtained funding to develop a comprehensive content hub specifically for esports. This platform will allow fans to easily discover tournament schedules and enjoy professional gameplay from titles like League of Legends and Starcraft 2, eliminating the need for extensive online searches.

Juked.gg previously participated in the 500 Startups program, initially gaining recognition as a valuable source for esports content. Following a successful funding round on the Republic platform, where they raised just over $1 million, the company is poised for expansion.

The Exchange discussed Juked.gg’s progress with co-founder and CEO Ben Goldhaber. According to Goldhaber, the platform has grown from 500 users at its launch in late 2019 to 50,000 by December 2020. Future plans for Juked.gg include increased investment in journalistic coverage, enhanced social features, and support for user-generated content. Further updates on Juked.gg’s development will be provided as the company implements its vision, backed by over $1 million from 2,524 investors who believe it is creating a crucial product for a rapidly expanding entertainment sector.

Andreessen Horowitz's Expansion into Media

I won't dwell on this topic extensively, as maintaining reasonable perspectives is important, but venture capital firms creating content isn't a recent development. Consider, for instance, how long ago First Round Review was initially released. The approach Andreessen Horowitz seems to be taking differs primarily in its breadth, rather than its fundamental nature. We discussed this further on Equity this week, should you be interested in a more detailed explanation.

Talkspace’s Potentially Sound SPAC Arrangement

Although it’s tempting to be critical of SPACs, many of which involve companies in their early stages, not every SPAC-initiated public offering is without merit. The upcoming deal involving Talkspace is a prime example, and the relevant investor presentation can be reviewed here.

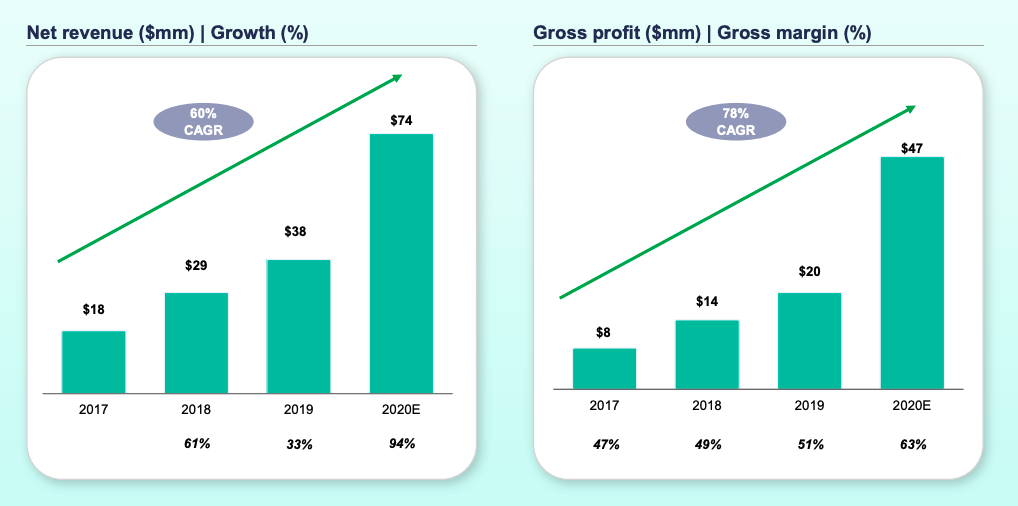

The key information is presented in the following set of charts:

These figures demonstrate a clear trend of historical revenue expansion! Furthermore, they reveal improvements in gross margins and a corresponding increase in gross profit!

One might question whether the company’s projected enterprise value of $1.4 billion, following its merger with Hudson Executive Investment Corp., is justified. However, it is undeniable that this represents a legitimate and functioning business.

How VCs and founders view 2021: A divergence in perspective

Recently, Seed VC firm NFX published a survey comparing the viewpoints of venture capitalists and startup founders, which I wanted to bring to your attention. The complete survey results are available for your review here.

I’ve highlighted two key findings from the report:

- Venture capitalists demonstrate a more optimistic outlook regarding the economy compared to founders. Approximately 30% of founders anticipate that consumer expenditure will remain stable or decrease, a sentiment shared by only about 17% of VCs.

- Regarding relocation away from the Bay Area – a frequently discussed topic – 35% of founders are considering a move, whereas only 20% of investors share this inclination. A possible explanation for this difference is that investors are more likely to own property in the Bay Area, while many founders do not. This suggests that the narrative of a mass exodus of capital and skilled individuals from the region may be overstated; such a widespread departure is not occurring.

The Appeal of Anywhere

Initialized Capital recently compiled information regarding founders’ preferred locations for establishing a business. In 2020, almost 42% of founders surveyed identified the Bay Area as the optimal choice. However, by 2021, this figure decreased to just over 28%, with the largest group – 42% – expressing a preference for a fully distributed company model.

This trend is something I frequently discuss with founders in the early stages of development. Many are creating what I refer to as micro-multinationals: compact organizations with a small team in one nation, and additional personnel in several others. I anticipate that successfully managing this type of structure will become a key area of focus for human resources software.

In any case, the necessity of launching companies specifically within the Bay Area is now obsolete. The benefits associated with being founded there, however, are likely to remain significant for quite some time.

What's Ahead!

Next week on The Exchange, we’ll be showcasing the initial submissions for our latest $50 million Annual Recurring Revenue series. This will include conversations with leaders from Assembly, SimpleNexus, Picsart, OwnBackup, and several other companies. We’ve also already completed interviews with businesses generating $100 million ARR.

In addition, to satisfy the interests of The Powers That Be, The Exchange this week reported on several interesting topics, such as the performance of American venture capital, investment in fintech and unicorn companies, venture capital activity in Europe and Asia, the increasingly unpredictable IPO landscape, and an assessment of Qualtrics’ potential valuation upon its public offering.

Best wishes, and let's all prioritize some rest,

Alex