how covid-19 accelerated doordash’s business

DoorDash submitted its initial public offering paperwork today, revealing financial data that demonstrated substantial growth, increased profitability, and a strengthening cash flow position. These figures help clarify how the company reached a $16 billion valuation while operating as a private entity. The anticipated public listing of this unicorn company will provide significant returns to numerous venture capital firms that invested in its long-term development.

Rather than publishing this installment of The Exchange on Monday, we are releasing it today for your Friday and weekend review. We hope you enjoy it! — Alex and Walter.

A key factor in DoorDash’s strong performance is the influence of COVID-19, which sped up existing market tendencies and fueled the company’s expansion. Before analyzing the pricing of this IPO and estimating the company’s potential value, it’s important to determine what proportion of its 2020 gains can be attributed to the pandemic – and may not be sustainable going forward.

Our intention isn’t to be negative; we simply aim for a more thorough understanding of the business. DoorDash shares this perspective, noting in its S-1 filing that “58% of all adults and 70% of millennials report a greater likelihood of ordering restaurant food for delivery now compared to two years ago,” and further stating that it “believes the COVID-19 pandemic has further accelerated these trends.”

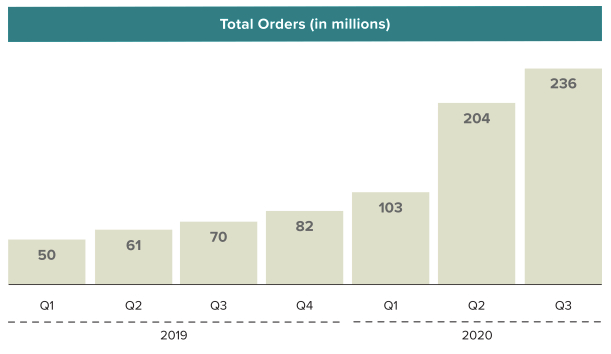

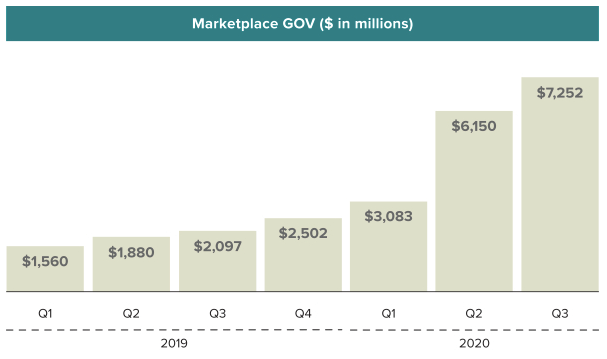

Furthermore, DoorDash explicitly states in its filings that COVID-19 resulted in “a considerable increase in revenue, Total Orders, and Marketplace [gross order volume] due to heightened consumer demand for delivery services, a larger number of merchants utilizing our platform for both delivery and takeout, and improvements in the effectiveness of our local logistics network.” The company also cautioned investors that “the conditions that have accelerated the growth of our business as a result of the COVID-19 pandemic may not persist, and we anticipate that growth rates in revenue, Total Orders, and Marketplace [gross order volume] will decrease in future periods.”

We are not making assumptions without basis.

Let’s examine how DoorDash’s growth progressed from 2019 to 2020 and then consider how the company’s financial performance improved during the same timeframe, potentially leading to adjusted profitability for the entire year – a rare achievement within the on-demand service sector.

Growth

DoorDash earns income when a customer places a food order through its platform, dividing the total amount—which includes food costs, taxes, fees, and tips—among itself, the restaurant fulfilling the order, and the delivery driver.

To illustrate how this split typically works, DoorDash provides an example based on approximate average order data from 2019:

- Total Bill: $32.90

- Restaurant: $20.10, representing 61%

- DoorDash: $4.90, or 15%

- Delivery Driver: $7.90, accounting for 24%

Considering that this data is from a previous period and DoorDash has experienced substantial growth in gross profit recently, it’s interesting to consider how things have evolved since the disruptions of 2020. However, the older figures are useful for understanding the relationship between gross order volume (GOV) and DoorDash’s revenue; as one increases, so does the other.

Therefore, as the number of orders increases:

And, as GOV increases, so does:

DoorDash’s revenue also increases, as demonstrated by a closer examination of the company’s overall performance.

These charts are presented not to underestimate your understanding, but to highlight the substantial impact that COVID-19 had on DoorDash, specifically the increase in order volume (shown in the first chart) and the value of those orders (shown in the second).

DoorDash’s order volume essentially doubled from the first quarter to the second, and then surpassed that level in the third, with order growth of just under 11% and GOV growth of 18%. This suggests an increase in average order size as well.

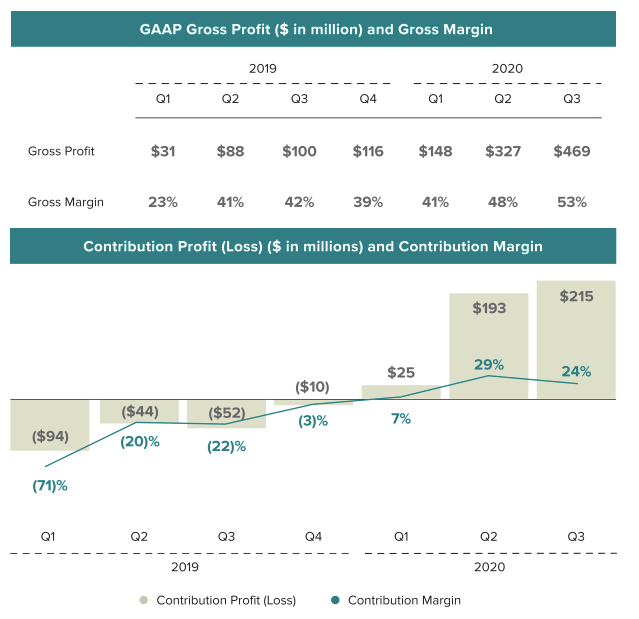

Importantly, DoorDash’s revenue quality (gross margin), its ability to cover its expenses (gross profit), and the profitability of its delivery operations (contribution margin) all improved significantly during these periods of growth.

The following table illustrates this situation. Notice the improvements in gross margin (revenue quality) beginning in the second quarter of 2020. Before this period, DoorDash’s gross margins remained between 42% and 39% for a year. Then, the gross margin moved beyond this range in the second quarter and continued to expand in the third. These changes enabled DoorDash to more than double its gross profit (funds available to cover its costs) by the middle of the year, and then significantly increase it further in the third quarter:

Similar improvements can be seen in the company’s contribution margin (unit economics), which turned positive in the first quarter of 2020 and then more than quadrupled in the second quarter. DoorDash’s contribution margin decreased in the third quarter, but its increasing order volume meant that its overall contribution profit still rose.

Therefore, the pandemic and the resulting changes to our lifestyles have been beneficial for DoorDash.

To clarify, acknowledging that DoorDash benefited from favorable conditions is not a criticism. It’s easy to be overwhelmed by a strong tailwind, to continue the analogy. Instead, DoorDash improved its business economics while expanding its revenue, allowing it to move from a history of adjusted losses to adjusted profit, and reduce its net income deficits to minimal levels relative to its scale and growth.

However, how did it achieve all of this?

As DoorDash mentioned in one of its earlier statements, COVID-19 was at least partially responsible for “increased consumer demand for delivery, more merchants using our platform to facilitate both delivery and take-out, and improved efficiency of our local logistics platform,” which suggests two key ideas:

- That the “improved efficiency of our local logistics platform” was significant, enabling the company to avoid proportional increases in spending to handle the increased delivery volume, thereby improving contribution margin per order.

- And that the rest of the company’s operations did not need to scale as quickly as its gross profit, allowing DoorDash to control expenses as a percentage of gross profit, bringing its GAAP profitability closer to breakeven.

In other words, the company benefited from COVID-related improvements in operational efficiency and overall operating leverage.

So, what will happen as the pandemic subsides? Several things are likely:

- Some economic gains may diminish: The pandemic provides benefits, but also takes them away. DoorDash will retain some gains as it won’t lose all of the scale driven by COVID-19—assuming that our behaviors have changed permanently to some extent, which is open to debate—but expecting it to keep all of the efficiencies gained during the pandemic is unrealistic.

- Revenue growth may slow: This is predictable, but we haven’t stated the worst-case scenario: Revenue growth could turn negative. To invest in the DoorDash IPO, especially at its current valuation of $25 billion, you must believe that the company’s revenue growth will slow only modestly at most. Otherwise, the price is not justified. Bearish investors who anticipate negative growth in the third quarter of 2021 will not invest in DoorDash shares, but between these two viewpoints lies a range of possibilities related to vaccine timelines, shifts in consumer behavior, and macroeconomic factors that could determine how many American families can afford delivery. All of these factors will impact DoorDash’s future growth rates.

The decision of whether or not to invest in the IPO is yours, but it will be a significant one.

DoorDash is capitalizing on the timing, presenting an impressive growth story fueled by COVID-related economic factors to portray a company that has mastered delivery and will continue to profit as couriers deliver its earnings.