Extra Crunch Roundup: Corporate Development, Chicago Startups & Brazil E-commerce

Navigating Venture Capital Meetings: A Founder's Perspective

Founders preparing to meet with venture capitalists should keep two key points in mind. First, recognize your own expertise. You possess the deepest understanding of your venture. Second, understand that investors are actively seeking justifications to approve investments.

Common Pitfalls in Fundraising

Despite this dynamic, many entrepreneurs inadvertently diminish their chances of success. This often stems from poorly directed questioning or a lack of clarity regarding their BATNA – the best alternative to a negotiated agreement.

Kunal Lunawat, co-founder of Agya Ventures, emphasizes the increasing importance of these strategies. As the venture capital landscape prioritizes merit and de-emphasizes traditional credentials, effective negotiation can be the deciding factor between securing funding and experiencing a disappointing outcome.

For those currently fundraising, or planning to do so, a valuable resource is “A crash course on corporate development,” recently shared by Venrock VP Todd Graham.

The Rising Tide of Acquisitions

Graham highlights the significant time founders may spend interacting with corporate development teams, particularly if an acquisition is anticipated. The current market conditions – characterized by strong stock performance, substantial cash reserves, and accessible debt – create a particularly favorable environment for acquisitions.

Access to complete Extra Crunch articles is a member benefit.

Utilize the discount code ECFriday for a 20% reduction on one- or two-year subscriptions.

Upcoming Twitter Spaces Event

Upcoming Twitter Spaces Event

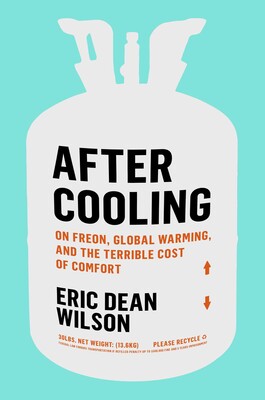

On Wednesday, August 24th at 3 p.m. PDT/6 p.m. EDT/11 p.m GMT, Managing Editor Danny Crichton will lead a discussion on Twitter Spaces. The guest will be Eric Dean Wilson, author of “After Cooling: On Freon, Global Warming, and the Terrible Cost of Comfort.”

Wilson’s work delves into the history of freon, a widely used refrigerant that was ultimately prohibited due to its detrimental effects on the ozone layer. Following their conversation, questions will be taken from the audience.

Thank you for reading Extra Crunch this week. Wishing you a productive and enjoyable weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

The Upcoming Shift in Apple’s Mail Privacy Protection and its Impact on Email Marketing

A significant portion of email opens – almost 50% – originate from devices like the Apple iPhone, Apple Mail application, and Apple iPad. However, the introduction of privacy enhancements within iOS 15 will empower users to restrict marketers’ access to crucial data points.

A significant portion of email opens – almost 50% – originate from devices like the Apple iPhone, Apple Mail application, and Apple iPad. However, the introduction of privacy enhancements within iOS 15 will empower users to restrict marketers’ access to crucial data points.Specifically, these new features will enable consumers to prevent the sharing of their precise location, IP address, and the tracking of engagement through methods like invisible pixels.

These metrics are fundamental to the strategies of many email marketers. Therefore, proactive preparation for these forthcoming changes is strongly recommended, according to Litmus CMO Melissa Sargeant.

Preparing for the Changes

Sargeant has published a comprehensive guide outlining several actionable steps. These steps are designed to help marketing teams optimize their email analytics.

The goal is to ensure they can still provide the individualized experiences that consumers now expect, even with reduced data availability.

- Focus on first-party data collection.

- Prioritize email deliverability best practices.

- Refine segmentation strategies.

By implementing these strategies, marketers can mitigate the impact of Apple’s privacy updates and maintain effective email campaigns.

Corporate Development: A Founder's Guide to Strategic Options

Todd Graham, a Vice President at Venrock, offers direct counsel to founders of venture-funded companies: achieving a return on investment should be a priority.

Todd Graham, a Vice President at Venrock, offers direct counsel to founders of venture-funded companies: achieving a return on investment should be a priority.He has created a guide to corporate development, detailing the three primary types of acquisitions. It also provides guidance on interacting with investment bankers and clarifies the potential drawbacks of large corporate partnerships.

Key Strategies for Founders

Graham emphasizes the importance of engaging in discussions, stating that “you need to take the meeting,” irrespective of initial impressions.

Even if the outcome isn't immediately favorable, a meeting can expand your professional network and increase visibility within the industry. A positive outcome could lead to further conversations.

Understanding Acquisition Categories

The guide outlines three common acquisition types. These represent the most frequent routes for startups to realize value.

- Strategic acquisitions are driven by synergy and market positioning.

- Financial acquisitions are motivated by investment returns.

- Acqui-hires focus on acquiring talent and expertise.

Founders should understand which category best aligns with their company’s profile. This understanding will inform their approach to potential acquirers.

Navigating Interactions with Investment Bankers

Effective communication with bankers is crucial during a potential sale. Graham advises founders to be prepared with detailed financial information.

Transparency and a clear understanding of your company’s value are essential for securing favorable terms. Bankers act as intermediaries, so clear messaging is paramount.

The Nuances of Corporate Partnerships

While partnerships with larger companies can seem appealing, they aren’t always the optimal path. Graham cautions against prioritizing partnerships over outright acquisition.

Partnerships can sometimes limit a startup’s growth potential and strategic flexibility. A full exit may offer a more substantial and immediate return.

Chicago Startups Benefited as Venture Capital Shifted to Zoom

Despite the challenges presented by the pandemic, investment in startups by venture capitalists continued at a strong pace.

Despite the challenges presented by the pandemic, investment in startups by venture capitalists continued at a strong pace.Chicago, however, uniquely benefited from this period, becoming a significant recipient of increased venture capital activity and the growing trend of remote investment, as detailed by Alex Wilhelm and Anna Heim in The Exchange.

The Rise of Remote Investing

The shift to remote interactions, particularly through platforms like Zoom, leveled the playing field for startups outside of traditional tech hubs.

Previously, location played a crucial role, with New York City and San Francisco holding significant advantages.

However, with everyone conducting meetings virtually, Chicago was well-positioned to showcase its startup ecosystem as a leading force in the Midwest.

Chicago's Preparedness

The city was prepared to demonstrate its capabilities when the need for remote presentations arose.

This readiness allowed Chicago-based startups to effectively compete for funding alongside companies in more established tech centers.

As a result, the Windy City emerged as a key beneficiary of the changing investment landscape.

Impact of the Pandemic on VC Funding

The pandemic did not hinder the flow of capital into startups; instead, it accelerated certain trends.

The adoption of remote investing practices proved particularly advantageous for cities like Chicago.

This shift enabled a broader range of startups to access venture capital, fostering innovation and growth throughout the Midwest.

The Implications of Brazil’s Updated Receivables Regulations for Fintech Companies

A significant overhaul of payment processing procedures by the Brazilian Central Bank has the potential to substantially expand e-commerce opportunities within South America’s largest economy.

Historical Context of Payment Options

Previously, businesses accepting credit card payments in Brazil were largely limited to two choices. They could either receive the total payment amount spread across a period of two to twelve installments, or they could provide a substantial discount in exchange for a quicker, reduced upfront payment.

The Introduction of New Regulatory Entities

In June 2021, the Brazilian Central Bank (BCB) introduced new “registration entities.” These entities allow “any interested party involved in purchasing receivables or acting as an acquirer to submit a bid for those receivables.”

This new system compels buyers to enhance the competitiveness of their discount offerings, as explained by Leonardo Lanna, head of payment products at Monkey Exchange.

Benefits for Consumers and Merchants

The revised framework is designed to provide advantages to both consumers and sellers. It fosters a more dynamic and efficient payment landscape.

Opportunities for Fintech Startups

For startups operating within the region, the changes “unlock a wide range of possibilities and innovative business models, spanning both payments and credit solutions.”

Fintechs are poised to capitalize on the increased competition and flexibility within the Brazilian payment ecosystem.

The new regulations are expected to drive further innovation and growth in the Brazilian fintech sector.

Key Takeaways

- The BCB’s reform aims to increase competition in the receivables market.

- Merchants now have more options for receiving payments.

- Startups can leverage the new framework to develop novel financial products.

Brazil's Startup Scene Poised for a Wave of IPOs

The Brazilian startup ecosystem is experiencing rapid growth, potentially leading to a significant increase in initial public offerings (IPOs). This acceleration is highlighted by a surge in venture capital investment, prominent company acquisitions, and a growing number of unicorn companies.

Growth Indicators in the Brazilian Tech Market

According to analysis by Anna Heim and Alex Wilhelm in The Exchange, several key trends are shaping the Brazilian tech landscape. A substantial influx of venture capital is fueling innovation and expansion within the sector.

Shifting IPO Dynamics

The Brazilian IPO market is undergoing a transformation. Historically, technology companies represented a small fraction of IPOs in the country.

Prior to 2020, only two out of 56 IPOs in Brazil were from the technology sector. However, this figure has dramatically increased in recent years.

- In 2019, there were just four technology companies publicly listed.

- Currently, at least 16 technology companies are listed on Brazilian stock exchanges.

This substantial rise indicates a growing maturity and investor confidence in Brazilian tech startups. The increasing number of publicly traded tech firms demonstrates a positive shift in the market.

Notable acquisitions are also contributing to the dynamism of the Brazilian tech startup market. These transactions signal a healthy level of activity and consolidation within the industry.

Strategies for a Simplified SOC 3 Certification Application

Achieving security certifications, such as SOC 3, is known to be a rigorous undertaking.

As Waydev CEO Alex Cercei notes in a recent guest article, the process demands significant effort.

Waydev, a platform specializing in Git analytics for automated engineering team performance measurement, has recently completed its own SOC 3 certification.

Lessons Learned During the Certification Process

The team at Waydev gained valuable insights throughout the certification journey.

Recognizing the potential challenges others may face, they are now sharing their experiences to assist those preparing for SOC 3.

Their aim is to provide guidance on navigating the SOC 3 process efficiently, while maintaining operational stability and minimizing impact on end-users.

Key Advice for a Smooth SOC 3 Application

The following recommendations are designed to help teams successfully achieve SOC 3 certification.

- Prioritize Documentation: Meticulous record-keeping is fundamental to the SOC 3 audit.

- Automate Where Possible: Leverage automation tools to streamline data collection and reporting.

- Dedicated Resources: Assign a focused team to manage the certification process.

- Early Preparation: Begin preparing well in advance of the target audit date.

By implementing these strategies, organizations can navigate the SOC 3 certification process with greater confidence and efficiency.

Balancing the demands of certification with ongoing operations is achievable through careful planning and execution.

Guidance for Inventive from India: Navigating the EB-1A and EB-2 NIW

Dear Inventive,

Your concerns regarding securing a green card while maintaining career flexibility are valid, particularly given your H-1B status and origin country. Exploring both the EB-1A (Extraordinary Ability) and EB-2 NIW (National Interest Waiver) pathways is a prudent approach.

Understanding the EB-1A Visa

The EB-1A category is designed for individuals who demonstrate extraordinary ability in the sciences, arts, education, business, or athletics. Meeting this standard requires substantial documentation of sustained national or international acclaim.

It’s understandable to be uncertain about your eligibility. The criteria are rigorous, demanding evidence far exceeding general excellence in your field.

EB-2 NIW: A Viable Alternative

The EB-2 NIW offers a pathway for those who can demonstrate that their work is in the U.S. national interest. This waiver eliminates the requirement for a job offer and labor certification.

You are correct to acknowledge the potentially extended processing times for EB-2 NIW applicants born in India due to country-specific quotas. However, it remains a frequently pursued option.

Strategic Considerations and Tips

Here are some recommendations to help you proceed:

- Comprehensive Self-Assessment: Objectively evaluate your achievements against the EB-1A criteria. Gather any evidence of significant awards, publications, or recognition.

- Focus on National Impact: For the EB-2 NIW, meticulously document how your work benefits the United States. This could include contributions to economic growth, scientific advancement, or public health.

- Strong Letters of Recommendation: Secure compelling letters from experts in your field who can attest to your abilities and the national importance of your work.

- Legal Counsel: Consult with an experienced immigration attorney. They can provide a detailed assessment of your qualifications and guide you through the complex application process.

- Concurrent Filing (Potential): Depending on your circumstances, it may be possible to concurrently file petitions for both EB-1A and EB-2 NIW, increasing your chances of success.

Addressing the Wait Times

While the wait times for EB-2 NIW applicants from India are longer, they are still generally more predictable than relying solely on employer sponsorship. Proactive planning and a well-prepared petition can help expedite the process.

Remember, a strong case built on demonstrable achievements and a clear articulation of national benefit is crucial for both visa categories.

Building a Health Tech Startup Advisory Board

An advisory board is beneficial for most startups, but it’s particularly crucial within the health technology sector.

An advisory board is beneficial for most startups, but it’s particularly crucial within the health technology sector.Health tech founders require guidance from experienced mentors who understand the complexities of this field.

These mentors should possess expertise in areas like regulatory compliance, capital acquisition, and research and development management.

Patrick Frank, co-founder and COO of PatientPartner, has outlined specific strategies for recruitment, sourcing, and equity allocation for advisory board members.

Frank emphasizes the importance of utilizing advisors to maintain focus on the broader company vision.

This ensures the development of a product or service that is both market-viable and attractive to potential investors, ultimately achieving scalability.

Key Considerations for Recruitment

Identifying the right individuals is paramount to the success of your advisory board.

Consider advisors with a proven track record in the health tech industry, possessing deep knowledge of the challenges and opportunities present.

Regulatory expertise is essential, given the highly regulated nature of healthcare.

Furthermore, advisors with experience in fundraising and R&D can provide invaluable support.

Where to Find Potential Advisors

Networking within the health tech ecosystem is a productive starting point.

Attend industry conferences, join relevant professional organizations, and leverage your existing network to identify potential candidates.

Online platforms like LinkedIn can also be utilized to search for individuals with specific expertise.

Don't overlook the potential of seasoned entrepreneurs who have successfully navigated the health tech landscape.

Structuring Equity and Compensation

Determining appropriate compensation for advisory board members requires careful consideration.

Equity is a common form of compensation, aligning advisors’ interests with the long-term success of the startup.

The amount of equity granted should reflect the advisor’s level of contribution and the value they bring to the company.

Clear agreements outlining the scope of work, compensation, and confidentiality are essential.

- Equity Grants: Typically range from 0.25% to 1% depending on involvement.

- Cash Retainers: An alternative or supplement to equity, offering a fixed fee for services.

- Milestone-Based Payments: Tie compensation to specific achievements, incentivizing performance.

By strategically assembling and engaging an advisory board, health tech startups can significantly increase their chances of success.

Positive Indicators Emerge in the Cryptocurrency Market

A review of recent technological developments reveals encouraging signals within the cryptocurrency sector, as observed by Alex Wilhelm.

This week’s analysis focused specifically on the digital currency landscape.

The rationale behind this focus stems from the identification of several bullish trends, suggesting the blockchain ecosystem is evolving and fostering the growth of successful ventures.

Maturation of the Blockchain Ecosystem

The cryptocurrency market is demonstrating characteristics of increased maturity.

This maturation process is actively contributing to the emergence of a number of prominent and successful participants.

Key Observations

- The blockchain space is no longer solely defined by speculative trading.

- A growing number of projects are delivering tangible value.

- Infrastructure development is supporting wider adoption.

These factors collectively point towards a more sustainable and robust future for cryptocurrencies.

Wilhelm’s assessment highlights a shift from initial hype to practical application and demonstrable progress.

Identifying Winning Players

The evolving landscape is facilitating the identification of companies poised for success.

These winning players are distinguished by their ability to innovate and address real-world challenges using blockchain technology.

Further analysis will be crucial to pinpoint specific companies and strategies driving this positive momentum.

Four Frequent Errors Startups Commit When Establishing Compensation for Hybrid Employees

A recent survey indicated that 58% of employees would consider resigning if remote work options are not provided.

A recent survey indicated that 58% of employees would consider resigning if remote work options are not provided.Startups failing to provide employees with work-from-home options face a significant competitive challenge.

However, determining equitable compensation for hybrid work arrangements presents a multifaceted problem.

Key Considerations for Hybrid Worker Pay

- Is it appropriate to adjust salaries based on the employee’s geographic location?

- What is the correct approach to compensating employees with identical roles, differing only in their work location (remote vs. in-office)?

- Is the methodology behind compensation decisions clearly communicated to all staff members?

Transparency in compensation practices is crucial for maintaining employee trust and morale.

Failing to address these questions can lead to dissatisfaction and potential talent loss.

A well-defined compensation strategy is essential for attracting and retaining skilled workers in today’s evolving work landscape.

Related Posts

21-Year-Old Dropouts Raise $2M for Givefront, a Nonprofit Fintech

Monzo CEO Anil Pushed Out by Board Over IPO Timing

Mesa Shutters Mortgage-Rewarding Credit Card

Coinbase Resumes Onboarding in India, Fiat On-Ramp Planned for 2024

PhonePe Pincode App Shut Down: Walmart's E-commerce Strategy