Founder's Guide to Managing Your Options Pool

The Evolving Value of Options for Startups

A traditional belief in the startup world states that cash is the most important asset. However, this may no longer hold true in the current financial landscape.

In today’s environment, where capital is readily available, the ability to offer options to potential employees is often more valuable than simply having a large cash reserve.

While numerous resources detail strategies for fundraising, comparatively little attention has been given to the crucial task of safeguarding a startup’s option pool.

Why Protecting Your Option Pool Matters

For founders, attracting and securing skilled individuals is paramount to achieving success. Effectively managing your option pool is arguably the most impactful step you can take to facilitate both the recruitment and retention of top talent.

Successfully navigating option pool management isn’t always straightforward. However, proactive planning and awareness of available tools can help founders avoid common mistakes.

Key Areas We Will Explore

This article will delve into the following aspects of option pool management:

- The dynamics of the option pool across various funding rounds.

- Frequently encountered challenges that founders face.

- Strategies for protecting your option pool, and methods for rectifying earlier errors.

Understanding these elements is vital for any founder aiming to build a strong and sustainable team.

Dilution is a natural part of the fundraising process, but careful management of the option pool can minimize its impact on founder equity and future hiring power.

Understanding Option Pool Dynamics: A Case Study

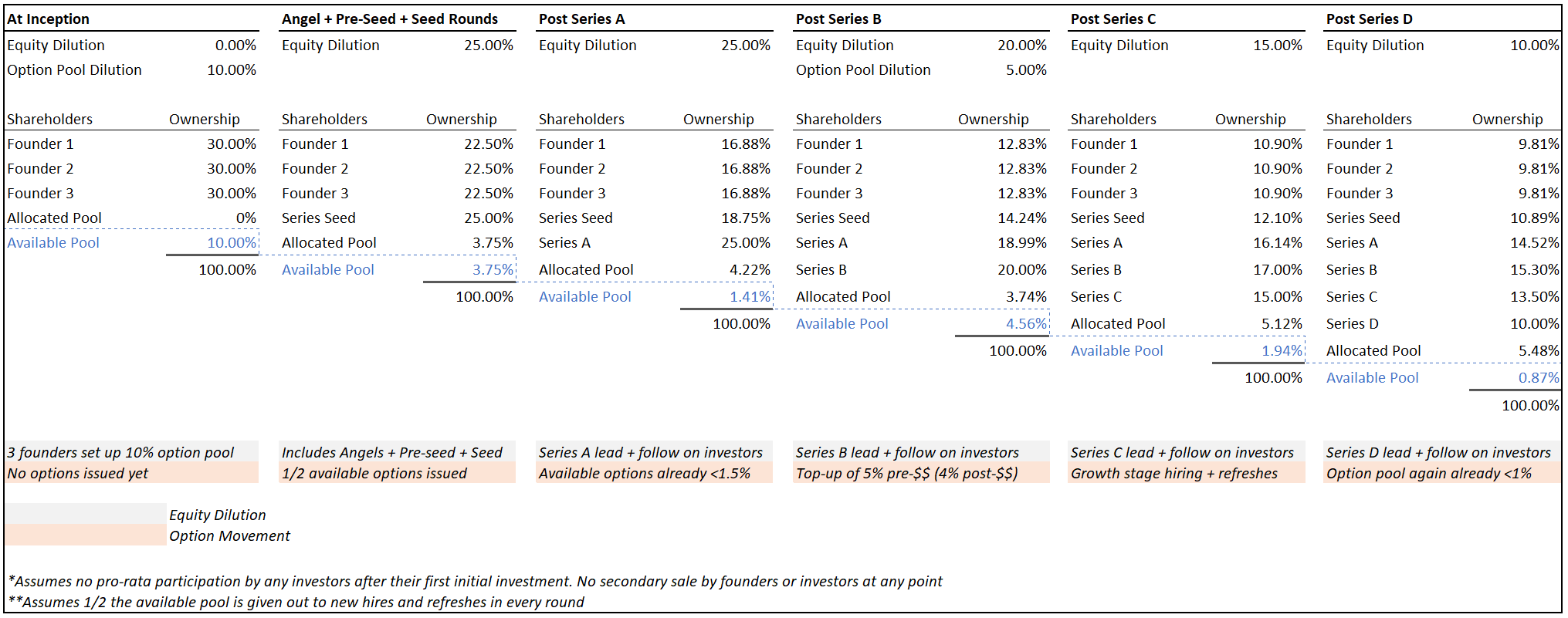

Let's examine a concise case study to establish a foundation before delving into more complex details. This scenario features three co-founders, equally invested, who choose to leave their current employment to launch a startup venture.

Recognizing the necessity of attracting skilled personnel, the founding team initiates operations with a 10% option pool established at the outset. They subsequently secure funding through angel, pre-seed, and seed investment rounds, experiencing a cumulative 25% dilution of equity across these stages, ultimately achieving product-market fit (PMF).

Following the attainment of PMF, a Series A funding round is completed, resulting in an additional 25% dilution. After onboarding several C-suite executives, the company finds its option reserves dwindling.

Option Pool Adjustments Through Funding Rounds

Consequently, prior to the Series B round, a 5% option pool top-up is implemented on a pre-money basis – alongside a 20% equity contribution linked to the new capital infusion. As the Series C and D rounds materialize, with respective dilutions of 15% and 10%, the company demonstrates substantial progress and prepares for an anticipated Initial Public Offering (IPO). This marks a significant success!

For clarity, certain assumptions are made to simplify the calculations, though these may not universally apply:

- Investors do not typically exercise their pro-rata rights following their initial investment.

- Approximately half of the available option pool is allocated to new hires or utilized for refresh grants with each funding round.

While each situation is unique, this model closely reflects the experiences of many startups. The following illustrates how the available option pool evolves across different funding stages:

Image Credits: Allen Miller

The rapid depletion of the option pool is evident, particularly in the early stages. While an initial 10% allocation appears substantial, attracting initial talent with limited resources and an unproven concept proves challenging. Furthermore, early funding rounds dilute equity not only for founders but also for the entire option pool, both allocated and unallocated.

By the time of the Series B round, the remaining available pool is reduced to less than 1.5%. The option pool top-up implemented at Series B, while helpful, is typically calculated on a pre-money basis.

Impact of Dilution and Future Top-Ups

This means the new equity introduced immediately dilutes the value of the top-up itself. Consequently, the actual increase to the pool is closer to 4 percentage points rather than the intended 5. The overall dilution experienced by all stakeholders – founders, employees, and investors – approaches 25%, compared to the 20% that would result from a standard equity round without a top-up.

At the Series D stage (two rounds after the top-up), the available options fall below 1%. This suggests the potential need for further top-ups, albeit at smaller scales. Fortunately, by the time of Series C and D, 1% of equity can support a significantly larger number of employees than 1% at the seed or Series A stage.

Larger funding rounds also enable more competitive cash compensation packages, which can offset smaller equity allocations. This allows the company to continue attracting and retaining top talent.

Common Pitfalls in Equity Management

Even in scenarios where founders proactively establish a 10% option pool and secure funding through appropriate rounds, resource constraints can still be a significant challenge. Operating with a limited budget, particularly in a competitive talent market, is a precarious position to be in.

The reality is that equity structures can become considerably more complex, potentially leading to a diminished option pool early on. This can severely hinder a company’s ability to attract and retain top talent.

Here are several common issues that can negatively impact your option pool:

Insufficient Initial Planning

A lack of foresight in establishing a sufficiently large option pool from the beginning is a frequent mistake. Underestimating future hiring needs or being overly concerned with maintaining ownership percentages can create problems. This is particularly common among first-time founders.

Co-founder Exits: When a co-founder with substantial equity departs, even if only a portion of their shares are vested, it can represent a significant loss. A 5%-10% portion of the cap table may become unproductive.

Over-allocation to Early Employees: Granting excessive equity to initial hires who are not adequately qualified or who demand disproportionate compensation, even considering the stage of the company, can be detrimental. Replacing these individuals with more experienced hires effectively results in "double paying" for the same role.

Premature Executive Hiring

Hiring senior leaders before the company is ready is another common error. For instance, bringing on a Chief Revenue Officer (CRO) at the Series A stage, when founder-led sales or a small team of Account Executives (AEs) would be more effective, can be a misstep. The impact of a CRO is often greater at the Series C stage and potentially less costly in terms of equity.

Delayed Performance-Based Decisions: Failing to leverage the one-year vesting cliff to evaluate employee performance can lead to regrettable outcomes. Allowing underperforming employees to remain with the company for extended periods results in wasted equity that could have been allocated to exceptional candidates. This must be balanced with fostering a positive work environment.

Lack of Data-Driven Equity Offers

Making equity offers based on intuition or gut feeling often leads to unfavorable results. This can manifest as either overpaying for talent or undervaluing candidates, potentially causing them to decline the offer. Utilizing industry benchmarks simplifies offer negotiations and conveys a sense of fairness and competitiveness.

Addressing Option Pool Mismanagement: A Path to Correction

If your company is in a growth phase or later stage and you've encountered challenges similar to those previously discussed, corrective measures are still achievable.

Expanding the Initial Pool: A proactive approach to avoid future option exhaustion is to establish a larger initial pool. While founders may be concerned about increased early dilution, the benefit lies in greater hiring flexibility and access to higher-caliber talent. This, in turn, can accelerate progress and facilitate more favorable fundraising terms with reduced overall dilution.

Consider this scenario: initiating with a 20% option pool instead of 10%, coupled with a 5 percentage point reduction in dilution at each subsequent funding round, could result in greater founder ownership, a more motivated workforce, and simplified pool management by the Series D stage. The projected outcome at Series D is visualized below:

Prioritizing Deliberate Hiring and Swift Action: Exercise caution and thoroughness when making hiring decisions, particularly for senior positions which typically carry higher costs. Should a new hire prove unsuitable, promptly address the situation, well before any vesting occurs. This principle extends to co-founders as well.

Prioritizing Deliberate Hiring and Swift Action: Exercise caution and thoroughness when making hiring decisions, particularly for senior positions which typically carry higher costs. Should a new hire prove unsuitable, promptly address the situation, well before any vesting occurs. This principle extends to co-founders as well.Implementing Extended Vesting Schedules: The departure of a co-founder can be particularly problematic due to the substantial equity they often hold. Mitigate this risk by implementing longer vesting periods, exceeding the standard four years, or structuring vesting with a back-loaded schedule, similar to Amazon’s approach. If a departing co-founder has already vested equity, explore the possibility of a share buyback at a discounted rate, returning those shares to the option pool.

Annual Compensation Planning: Conducting annual budget and planning sessions focused on employee compensation allows for proactive forecasting of key hires and their associated option grants. Typically during the mid-growth stages, establishing a compensation committee, led by an independent board member, is advisable to review and recommend compensation decisions to the full board.

Leveraging Compensation Data Tools: As your company expands, utilizing startup compensation tools like Option Impact, Carta Total Comp, and Pave becomes essential. These tools ensure competitive offers based on stage, location, and role, preventing over-allocation of equity. Supplement this data with insights from fellow founders and investors.

Linking Refreshes and Earn-Outs to Performance: Tie option refreshes and earn-outs to measurable performance, particularly for revenue-generating roles. This approach incentivizes accelerated growth, benefiting both the company and its employees. Exceptional performance should be rewarded with additional equity.

Shifting Towards Cash Compensation in Later Stages: As your company matures and risk diminishes, prioritize cash compensation. Equity's relative value decreases, and available capital allows for increased base salaries and bonuses. The equity required to hire a significant number of employees becomes less substantial.

Employing Buybacks for Non-Dilutive Pool Growth: Consider buybacks from angels, early investors, and employees who have realized returns, potentially allowing them to exit their positions. Repurchased shares can then be added back into the option pool without further dilution.

A crucial point to remember is the importance of fundraising at milestones that minimize dilution. While aiming for 25% dilution before Series A is ideal, it often ranges between 30% and 40% in practice.

Subsequent fundraising rounds and option pool replenishments can exacerbate dilution. Focusing on achieving key milestones before seeking capital prevents premature and excessively dilutive funding rounds.

Effective option pool management is vital for your startup’s long-term success. Your option pool represents a critical asset as a founder. Through careful planning and strategic execution, it can become a powerful engine for growth and value creation.

Related Posts

Trump Media to Merge with Fusion Power Company TAE Technologies

Radiant Nuclear Secures $300M Funding for 1MW Reactor

Coursera and Udemy Merger: $2.5B Deal Announced

X Updates Terms, Countersues Over 'Twitter' Trademark

Slate EV Truck Reservations Top 150,000 Amidst Declining Interest