spac charts are exercises in the limits of hype

The Questionable Optimism of SPAC Investor Decks

After reviewing a significant number of SPAC investor presentations over the past year, a certain pattern began to emerge that caused some concern. Despite a generally conservative outlook, the level of bullish projections presented often felt excessive.

Traditional IPO S-1 filings, in contrast, offer a more grounded approach. When it comes to financial figures, these documents tend to be remarkably straightforward. They generally refrain from including forecasts extending beyond the immediate year, and certainly not for a five-year period. While companies will naturally present their business model and strategies, S-1 filings maintain a reasonable degree of honesty.

Exaggerated Growth Projections

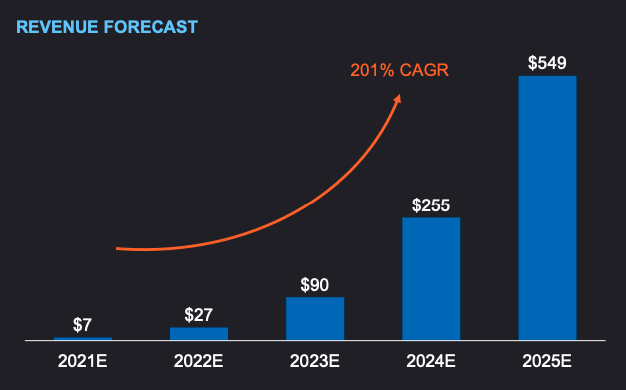

SPAC investor decks frequently diverge from this standard. Consider the following chart:

Past revenue figures seem almost irrelevant when confronted with such ambitious growth forecasts. A projected CAGR of 201% is presented, raising questions about its feasibility.

Past revenue figures seem almost irrelevant when confronted with such ambitious growth forecasts. A projected CAGR of 201% is presented, raising questions about its feasibility.

Further Examples of Optimistic Projections

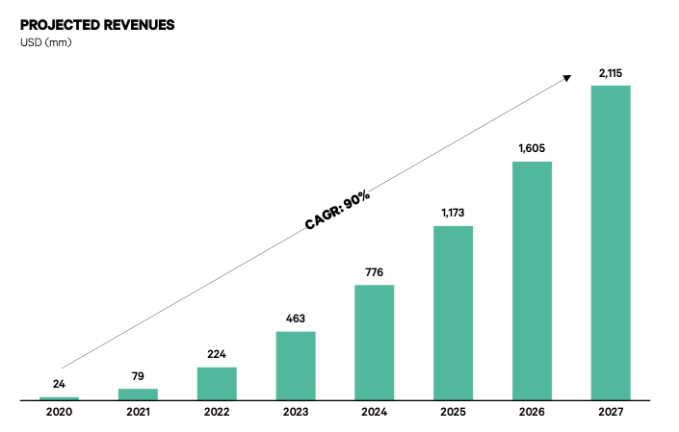

Another illustrative example can be found here:

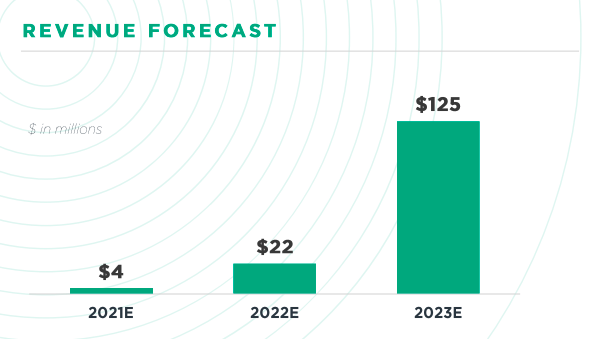

The presentation from Local Bounti provides another example:

The presentation from Local Bounti provides another example:

A Lack of Historical Data

A Lack of Historical Data

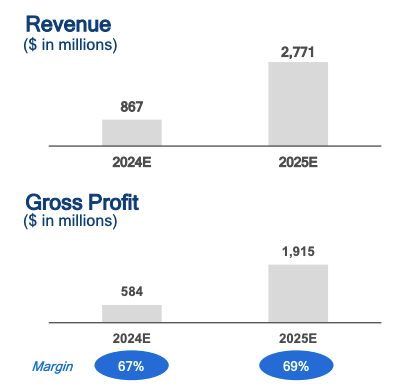

Pear Therapeutics also presented projections without sufficient supporting data:

Similarly, the recent Embark deal lacked clarity regarding past performance and near-term expectations:

Similarly, the recent Embark deal lacked clarity regarding past performance and near-term expectations:

Given the questionable accuracy of SPAC predictions, a healthy dose of skepticism is warranted.

Given the questionable accuracy of SPAC predictions, a healthy dose of skepticism is warranted.Related Posts

pat gelsinger wants to save moore’s law, with a little help from the feds

aws re:invent was an all-in pitch for ai. customers might not be ready.

anthropic ceo weighs in on ai bubble talk and risk-taking among competitors

legal ai startup harvey confirms $8b valuation

andy jassy says amazon’s nvidia competitor chip is already a multibillion-dollar business