Scalapay Raises $48M to Expand Buy Now, Pay Later in Europe

Services allowing consumers to purchase goods and settle the balance through installments have experienced significant growth in recent times. Scalapay, a company focused on developing a platform for these “buy now, pay later” (BNPL) options and related functionalities, has recently secured funding to strengthen its competitive standing against companies such as Klarna, Afterpay and Affirm.

The Milan, Italy-based startup has obtained $48 million in investment, which will be allocated to further development of its platform’s technology, expansion of its services throughout Europe, and initial efforts to enter the U.S. market.

Fasanara Capital led the funding round, with participation from Baleen Capital and Italian family office Ithaca Investments. This represents the startup’s first major funding event since its launch in 2019.

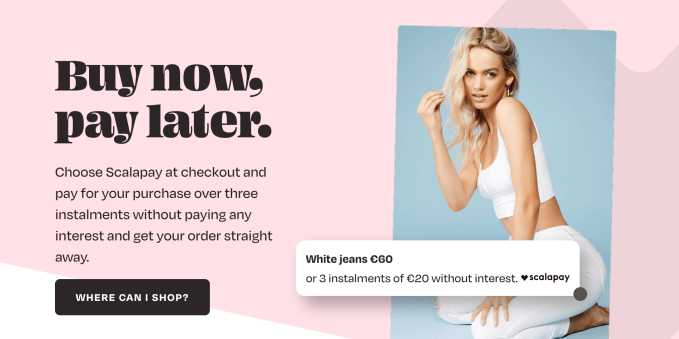

Scalapay’s core service centers around a streamlined sign-up process, followed by an agreement to repay the total amount in three equal installments, charged to the customer’s bank account or credit card.

Similar to companies like Affirm, Scalapay does not impose interest charges or additional fees on consumers. Instead, its revenue model relies on collecting a commission from merchants for each transaction, based on the premise that offering a convenient and rapid BNPL service will boost conversion rates and average order values.

Currently, the startup collaborates with approximately 1,000 merchants across Europe, including prominent European retailers like Decathlon, Calzedonia, Bata, Aosom and Bricobravo, operating in France, Italy, and Germany. The company asserts its position as the leading BNPL provider in its domestic market.

A recent partnership with banking “marketplace” Raisin Bank will soon enable Scalapay to extend its BNPL services to merchants in any European country.

According to CEO and co-founder Simone Mancini, the company intends to incorporate additional countries and related payment features, encompassing customer acquisition, conversion, retention, and order fulfillment processes.

Scalapay currently showcases merchants offering its BNPL service on its website, and these listings generate an average of 1 million referrals monthly. The company is developing a product based on this concept as part of its expansion strategy.

Installment-based payment options were not always prevalent online, with BNPL evolving from traditional brick-and-mortar practices like layaway or in-store financing, particularly for higher-priced items such as televisions.

However, the success of established online services like Klarna, as well as Affirm and Afterpay, has created opportunities for newer companies like Scalapay and Alma to emerge.

These companies have benefited from the current economic climate.

The surge in e-commerce activity, driven by consumers avoiding physical stores (when open) for social distancing purposes, combined with increased financial instability among many consumers due to the pandemic, has heightened the appeal of flexible payment options.

This shift has also influenced the average value of purchases made on installments. Mancini stated that the average transaction amount on Scalapay is currently around €100, highlighting consumers’ preference for avoiding upfront payments and offering an interesting point for microeconomic analysis regarding future trends.

The relatively modest transaction amounts may contribute to Scalapay’s favorable performance in terms of default and approval rates. Mancini reported a “first purchase approval rate” of approximately 93%, varying by product category, and a default rate below 1.5%.

While these figures are positive, they are comparable to those of its competitors.

Looking ahead, Scalapay’s key challenges will extend beyond developing robust algorithms to assess creditworthiness and prevent fraud. The company will also need to differentiate itself within a crowded market of providers offering similar basic services.

Interestingly, Scalapay’s website design shares similarities with Klarna’s, with both companies prominently featuring pink in their branding.

Simone Mancini relocated to Italy from Australia, where his co-founder Johnny Mitrevski continues to lead research and development, to establish Scalapay. He explained that Australia’s highly competitive market, dominated by Afterpay, contrasted with Italy’s relatively underdeveloped BNPL landscape, making Italy a more strategic choice.

The company’s focus on expanding beyond fundamental BNPL functionalities is also expected to contribute to its brand recognition and business diversification.

“I was impressed with the fast growth of the company and the underlying model,” stated Francesco Filia, CEO of Fasanara Capital. “They have demonstrated resilience during a challenging period and I am enthusiastic about the company’s future direction.”

“Scalapay’s platform provides a positive experience for customers while delivering substantial results for merchants,” added Fang Li, Managing Partner of Baleen Capital. “As a long-term investor in the BNPL sector, I have been extremely impressed by Scalapay’s team, execution, and product vision. I believe the company is well-positioned to become a leading partner for European retailers.”