google pay update adds grocery offers, transit expansions and spending insights

Google Pay Receives Feature Enhancements for Daily Use

Subsequent to a significant update to Google Pay in November, which broadened the service’s scope to encompass personal finance management, the company is now introducing a new suite of functionalities. These additions are designed to integrate Google Pay more seamlessly into the daily routines of its users.

The update brings new capabilities for grocery savings, public transportation fare payment, and detailed spending categorization.

Grocery Savings and Deals

Through collaborations with Safeway and Target, Google Pay users can now view weekly store circulars showcasing current promotions. Over 500 Safeway locations are now integrated with the Google Pay platform, and Target stores across the nation will offer a comparable feature.

Users are able to save recommended deals for future reference. Furthermore, Google Pay will soon provide notifications regarding weekly deals when a user is in proximity to a participating store, provided location services are enabled.

Expanded Transit Support

Expanded Transit Support

Google Pay’s transit features are being expanded, already supporting the purchase and utilization of transit tickets in over 80 U.S. cities. Soon, major metropolitan areas like Chicago and the San Francisco Bay Area will be added to this list.

This expansion follows Apple Pay’s recent and well-received support for the Bay Area’s Clipper card. Integration with Token Transit is also underway to broaden transit support to smaller communities throughout the U.S.

Android users will soon be able to access transit tickets directly from the Google Pay app’s home screen via a “Ride Transit” shortcut. This allows for convenient purchase, balance addition, or top-ups for transit cards. Upon purchase, users can present their transit card to a reader or display a visual ticket if a reader is unavailable.

Enhanced Financial Insights

Enhanced Financial Insights

A new feature is being introduced for users who utilize Google Pay for financial management. Last year, Google partnered with 11 banks to introduce Plex, a novel type of bank account.

Google’s app functions as the user interface for these accounts, which are hosted by partner banks such as Citi and Stanford Federal Credit Union.

Google Pay users will now have improved access to their spending patterns, account balances, and upcoming bills through a dedicated “Insights” tab. This tab provides visibility into balances, due bills, alerts for significant transactions, and spending tracking categorized by type or vendor.

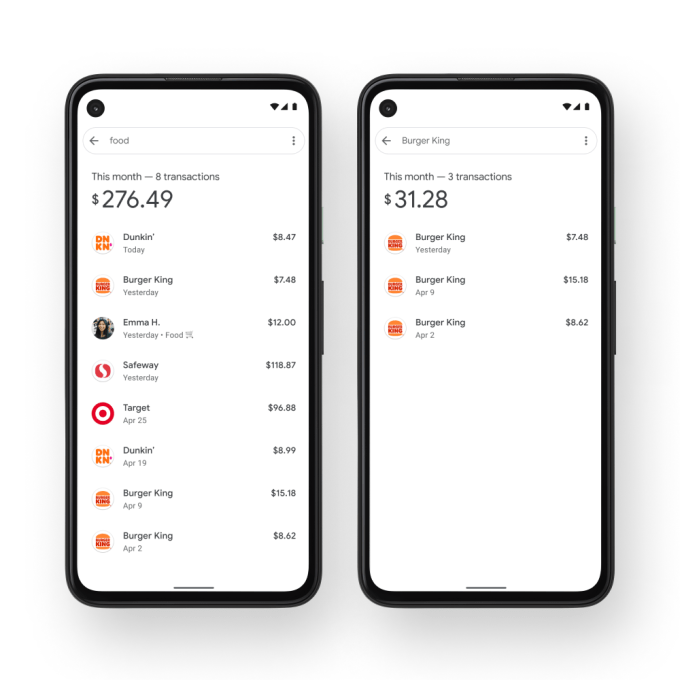

Because Google is automatically categorizing transactions, users can search using broad terms (e.g., “food”) or specific business names (e.g., “Burger King”), as explained by Google.

Image Credits: Google

Image Credits: Google

These enhancements are part of Google’s broader strategy to leverage the payments application to gather more user data. This data can then be used to deliver targeted offers from Google Pay partners.

Upon the launch of the redesigned app, users were prompted to enable personalization features, which could improve the relevance of deals presented. While Google asserts that user data is not directly shared with third-party brands and retailers, the app facilitates a channel for these businesses to connect with potential customers amidst evolving privacy standards and changes within the tracking industry.

Google’s capacity to connect brands with consumers through Google Pay could become a significant asset, contingent upon expanding its user base and encouraging greater adoption of personalization features.

Further useful and compelling features are anticipated to be rolled out in the coming weeks to achieve this growth.

Sarah Perez

Sarah Perez: A TechCrunch Reporter's Background

Sarah Perez has been a dedicated reporter for TechCrunch since August 2011. Her tenure at the company followed a significant period of experience gained elsewhere.

Previous Experience

Before joining TechCrunch, Sarah spent more than three years contributing to ReadWriteWeb. This role built upon a foundation established through prior professional endeavors.

Sarah’s career path began in the field of Information Technology. She accumulated experience working in I.T. roles across diverse sectors.

Industry Background

- Banking: Sarah has worked within the financial industry.

- Retail: Her I.T. experience extends to the retail sector.

- Software: She also possesses a background in the software industry.

Contact Information

For inquiries or to confirm communication originating from Sarah, she can be reached via email. Her email address is sarahp@techcrunch.com.

Alternatively, secure communication can be established through Signal. Her Signal username is sarahperez.01.