Coinbase S-1: 5 Key Takeaways for Investors

Coinbase S-1 Filing: A Strong Fourth Quarter Performance

The S-1 filing for Coinbase is now available for review. The company demonstrated a particularly strong financial performance during the fourth quarter of the previous year.

TechCrunch has initially analyzed the key financial figures. For those who haven't yet examined the details, it's important to note that Coinbase exhibited substantial growth from 2019 to 2020.

Revenue Growth and Profitability

In 2019, Coinbase generated over $500 million in revenue, experiencing a modest net loss. However, by 2020, the company’s revenue increased significantly, exceeding $1.2 billion and resulting in considerable net income.

The Exchange provides insights into startups, markets, and financial matters. Access it daily on Extra Crunch, or subscribe to The Exchange newsletter each Saturday.

Coinbase’s revenue in the fourth quarter of 2020 matched its total revenue for the entirety of 2019. This revenue was considerably more profitable due to its concentration within a single quarter.

Deeper Dive into Coinbase’s Performance

Beyond the headline revenue figures, numerous details warrant further investigation. A more thorough analysis will focus on Coinbase’s user base, the composition of its assets, the expansion of its subscription revenue streams, its competitive position, and the company’s ownership structure.

Furthermore, we will examine a chart illustrating the relationship between cryptocurrency assets and the stock market, offering an additional perspective.

Interested parties can access the complete S-1 filing here. Page numbers will be referenced throughout this analysis for easy navigation.

Inside Coinbase’s direct listing

Let's explore Coinbase’s direct listing by addressing key questions. First, how many users were necessary to achieve Coinbase’s substantial revenue increase in 2020?

The answer is surprisingly modest. In 2019, Coinbase reported $533.7 million in revenue from 1 million "Monthly Transacting Users" (MTU) (page 14). This equates to $533.7 in revenue per MTU annually.

In 2020, revenue climbed to $1.28 billion from 2.8 million MTUs, averaging approximately $457 per MTU for the year. While slightly lower, this figure remains significant. Considering transaction margins were consistently in the mid-80s percent throughout much of 2020, each active Coinbase trader proved highly valuable.

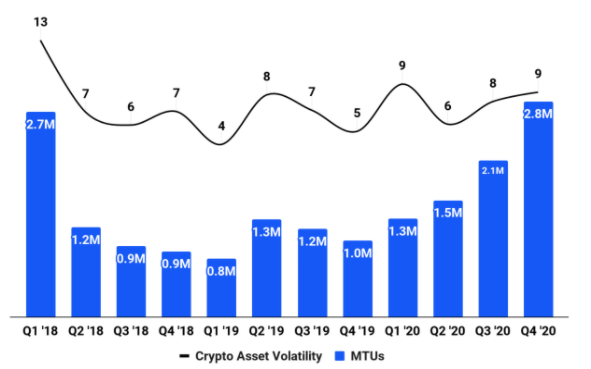

As previously discussed, Coinbase’s metrics exhibit considerable fluctuation. The MTU figure is no exception. Consider the following chart from its S-1 filing (page 95):

Coinbase’s MTUs in Q1 2018 were comparable to those in the final quarter of 2020. Subsequently, MTUs decreased by 70 percent to their lowest point in Q1 2019. This demonstrates substantial variability.

The company acknowledges in its filing that “MTUs have historically been correlated with both the price of Bitcoin and Crypto Asset Volatility,” while also anticipating a lessening of these correlations over time.

Therefore, only a few million MTUs are required for Coinbase to achieve significant business success. However, it’s important to note that Coinbase has experienced declines in trader numbers twice in recent years (2018 and 2019).

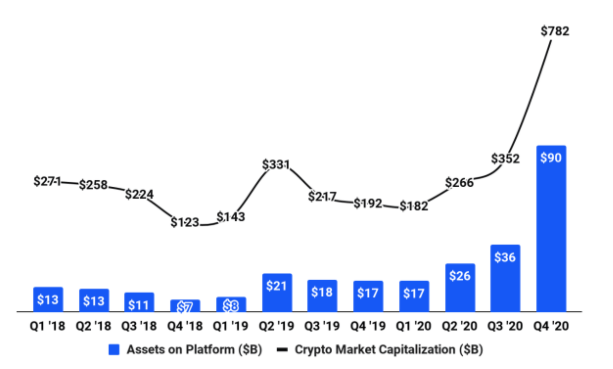

What assets are held by Coinbase users? This is a question of interest to many cryptocurrency enthusiasts. Let’s first examine the overall asset base of Coinbase users, as depicted historically (page 96):

The chart illustrates two key trends. First, the overall appreciation of cryptocurrencies, visible in the upward trend of the black line. Second, the growth of assets held on Coinbase’s platform, increasing from $17 billion at the beginning of 2020 to $90 billion by the end of the year.

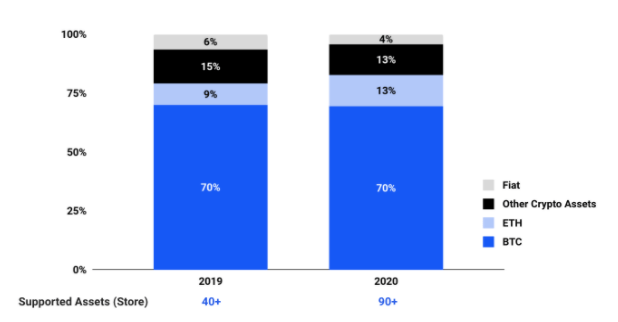

Let’s break down the composition of these assets (page 97):

The chart reveals that despite expanding its supported assets, Bitcoin maintained its dominant position. Simultaneously, fiat currency decreased by 2 percent, representing a third of the total assets on Coinbase during 2020.

Now, let’s consider: does Coinbase generate significant revenue from non-trading software? The answer is currently no.

Coinbase is experiencing growth in revenue from its software products. These efforts could potentially help the company navigate market instability and fluctuations in trading volume. However, this is not yet the case.

Here are Coinbase’s “subscription and services revenue” results for 2020 (page 110):

- Q1: $7.1 million

- Q2: $6.5 million

- Q3: $10.8 million

- Q4: $20.7 million

Such growth in this revenue category alone would be noteworthy for a company without a trading business. However, compared to total Q4 2020 revenues of $585.1 million, this category remains relatively small. It may become more significant over time, but Coinbase’s revenue is primarily driven by consumer trading activity in Bitcoin and other cryptocurrencies.

Finally, if Coinbase is performing as well as indicated, who does Coinbase identify as its primary competitors? While user apathy regarding buying and selling Bitcoin represents a key challenge, the company provided investors with a detailed overview of its market competition across various categories (page 148, emphasis added by TechCrunch).

From a broad perspective:

Specifically, concerning retail users:

Related Posts

21-Year-Old Dropouts Raise $2M for Givefront, a Nonprofit Fintech

Monzo CEO Anil Pushed Out by Board Over IPO Timing

Mesa Shutters Mortgage-Rewarding Credit Card

Coinbase Resumes Onboarding in India, Fiat On-Ramp Planned for 2024

PhonePe Pincode App Shut Down: Walmart's E-commerce Strategy