extra crunch roundup: edtech vc survey, 5 founder mistakes, fintech liquidity, more

The educational technology (edtech) landscape has grown so significantly that we now require more easily understood terminology to accurately categorize the diverse array of products, services, and tools it includes.

Consider someone who regularly shares stories with their grandchildren across different continents using Zoom each week. Would this be considered “edtech?”

Likewise, following the popularity of “The Queen’s Gambit,” numerous Netflix viewers began seeking online chess instruction, yet it’s unlikely they all initiated their search with the term “remote learning.”

To ensure long-term viability, edtech must extend its reach beyond solely under-resourced public school systems, which is why increasing numbers of investors and entrepreneurs are concentrating on lifelong learning opportunities.

Beyond providing conventional students with experiences like field trips and art classes, the edtech industry is evolving to encompass offerings such as software-based tutoring, cooking courses, and vocal lessons.

For a recent survey of investors, Natasha Mascarenhas interviewed 13 edtech venture capitalists to gain insight into how “employer-driven skill development and a resurgence of interest in personal growth” are broadening the sector’s total addressable market.

Here are the individuals she consulted:

- Deborah Quazzo, managing partner, GSV Ventures

- Ashley Bittner, founding partner, Firework Ventures (a future of work fund with portfolio companies LearnIn and TransfrVR)

- Jomayra Herrera, principal, Cowboy Ventures (a generalist fund with portfolio companies Hone and Guild Education)

- John Danner, managing partner, Dunce Capital (an edtech and future of work fund with portfolio companies Lambda School and Outschool)

- Mercedes Bent and Bradley Twohig, partners, Lightspeed Venture Partners (a multistage generalist fund with investments including Forage, Clever and Outschool)

- Ian Chiu, managing director, Owl Ventures (a large edtech-focused fund backing highly valued companies including Byju’s, Newsela and Masterclass)

- Jan Lynn-Matern, founder and partner, Emerge Education (a leading edtech seed fund in Europe with portfolio companies like Aula, Unibuddy and BibliU)

- Benoit Wirz, partner, Brighteye Ventures (an active edtech-focused venture capital fund in Europe that backs YouSchool, Lightneer and Aula)

- Charles Birnbaum, partner, Bessemer Venture Partners (a generalist fund with portfolio companies including Guild Education and Brightwheel)

- Daniel Pianko, co-founder and managing director, University Ventures (a higher ed and future of work fund that is backing Imbellus and Admithub)

- Rebecca Kaden, managing partner, Union Square Ventures (a generalist fund with portfolio companies including TopHat, Quizlet, Duolingo)

- Andreata Muforo, partner, TLCom Capital (a generalist fund backing uLesson)

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

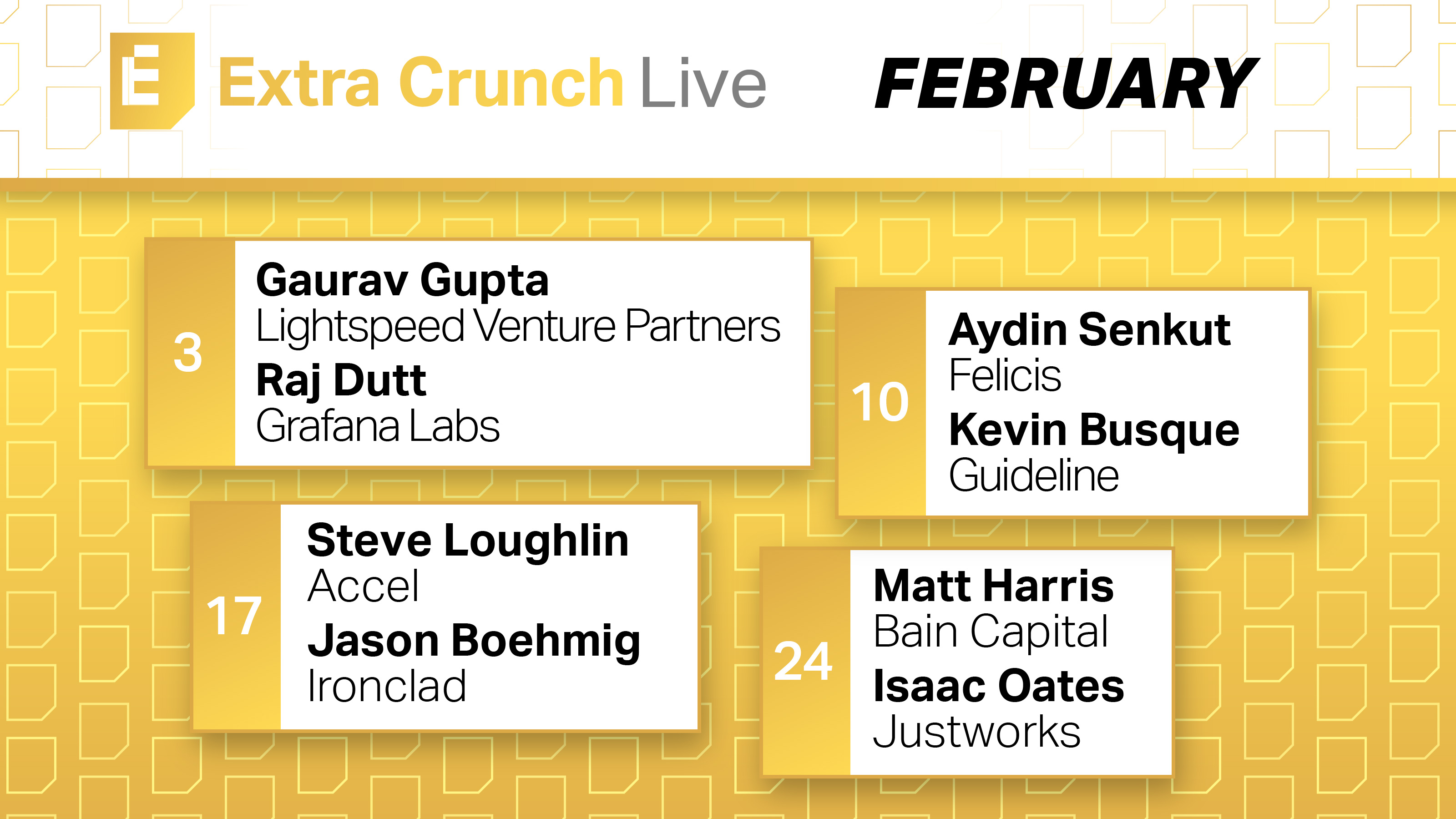

Additionally, Extra Crunch Live, a series featuring interviews with prominent investors and entrepreneurs, will return next month with a comprehensive lineup of guests. This year, a new component is being introduced: Our guests will evaluate pitch decks submitted by audience members, providing feedback on their strengths and areas for improvement.

If you are interested in having an expert review your pitch deck, please subscribe to Extra Crunch and participate in the discussion.

Thank you for your time reading! I wish you a wonderful weekend – it’s well deserved.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Thirteen investors indicate continuous education is propelling edtech into a dominant position

Increased investment in African ventures fueled fintech and clean technology initiatives in 2020

Following the day’s significant news events, Alex Wilhelm analyzed venture capital trends in Africa during 2020 on this morning’s edition of The Exchange.

Following the day’s significant news events, Alex Wilhelm analyzed venture capital trends in Africa during 2020 on this morning’s edition of The Exchange.His analysis of total data from 2020 compared to 2019 indicates that the previous year represented a relatively strong period for African startups, despite a decrease in the number of very large investment rounds.

To provide further insight, he spoke with Dario Giuliani, the research director at Briter Bridges, a firm specializing in research concerning developing markets in Africa, Asia, and Latin America.

Skilled professionals and financial resources are causing cybersecurity investors to look beyond Silicon Valley

Emerging cybersecurity hubs are developing in various global locations.

Emerging cybersecurity hubs are developing in various global locations.While some of this expansion is due to companies leaving the Bay Area, numerous early-stage security companies were already well-established in East Coast metropolitan areas such as Boston and New York.

In the UK and throughout Europe, governmental initiatives designed to encourage innovation have assisted entrepreneurs in securing increased funding through Series A and Series B investment rounds.

Investment attention and specialized knowledge are moving away from Silicon Valley; this article will explain the new destinations for these resources.

Could the impressive performance of Apple’s iPhone 12 significantly benefit the smartphone market in 2021?

Modern smartphones offer an extraordinary range of capabilities and are built to last, which explains the recent deceleration in sales growth.

Modern smartphones offer an extraordinary range of capabilities and are built to last, which explains the recent deceleration in sales growth.For a considerable number of users, a device acquired just a year and a half ago likely still meets their needs, particularly during periods of financial instability.

However, Apple generated $65.68 billion in phone sales during the last quarter, contributing to a total revenue of $111.4 billion, and this was largely due to the introduction of the iPhone 12.

As Hardware Editor Brian Heater notes, while “Apple’s quarterly results represented a unique confluence of factors,” it is reasonable to anticipate a recovery for the broader smartphone industry in the coming year.

The 5 biggest mistakes I made as a first-time startup founder

Rami Essaid, co-founder and CEO of Finmark, authored an article for Extra Crunch detailing the pitfalls he encountered that hindered his performance as an entrepreneur.

Rami Essaid, co-founder and CEO of Finmark, authored an article for Extra Crunch detailing the pitfalls he encountered that hindered his performance as an entrepreneur.Having collaborated with numerous founders across various startups, I found each of his observations to be particularly insightful and relatable.

Frequently, founders struggle with the act of assigning responsibilities to others, a challenge that can rapidly lead to difficulties in both company culture and day-to-day operations. Rami’s account confirms this observation:

Dear Sophie: How can I sponsor my mom and stepdad for green cards?

Dear Sophie:

Dear Sophie:I recently became a U.S. citizen! My spouse and I are hoping to have my mother and her husband immigrate to the United States to assist with the care of our young children, who are of preschool and toddler age.

My father, from whom I am biologically related, died some time ago when I was already an adult, and my mother has since entered into a new marriage.

Is it possible for them to obtain lawful permanent residency?

— Grateful in Aptos

Discover the impressive group of experts participating in Extra Crunch Live this February

Extra Crunch Live will be back next month featuring a distinguished panel of individuals with significant expertise in the realm of early-stage companies.

Tune in each Wednesday at 12 p.m. Pacific Time / 3 p.m. Eastern Time to hear discussions with company founders and the investors who provided funding:

February 3:

Gaurav Gupta, of Lightspeed Venture Partners, alongside Raj Dutt from Grafana Labs

February 10:

Aydin Senkut of Felicis Ventures and Kevin Busque of Guideline will be participating.

February 17:

Steve Loughlin from Accel will join Jason Boehmig of Ironclad.

February 24:

Matt Harris of Bain Capital and Isaac Oates from Justworks are scheduled to appear.

A new element is being introduced to Extra Crunch Live – our featured guests will now be offering guidance and constructive criticism on pitch decks submitted by members of the Extra Crunch audience!

10 VCs Predict Interactivity, Regulation & Independent Creators Will Define Digital Media in 2021

The recent pandemic has altered many people’s daily routines, leading to a shift in how we interact with digital media.

The recent pandemic has altered many people’s daily routines, leading to a shift in how we interact with digital media.As an example, I recently invested in new furniture, including a sofa and curtains, due to the uncertainty surrounding the reopening of movie theaters.

Last year witnessed nearly $800 million in spending by podcast sponsors targeting listeners, and projections indicate that ad revenue will exceed $1 billion this year. This demonstrates that many individuals, like myself, utilized promotional codes to purchase new items in 2020.

I currently subscribe to a multitude of streaming services, making it challenging to keep track. However, a new voice-controlled remote included with my cable package simplifies the process of selecting content.

Digital media reporter Anthony Ha consulted with 10 venture capitalists who focus on media startups to gain insights into the future of the industry. A key question explored was the longevity of conventional advertising approaches.

Given the vast number of available channels, how can content creators effectively capture audience attention? What kinds of tools will emerge to assist us in navigating between diverse options, such as a crime drama set in Scandinavia and a revival of a 1990s television comedy?

Here are the individuals Anthony spoke with:

- Daniel Gulati, founding partner, Forecast Fund

- Alex Gurevich, managing director, Javelin Venture Partners

- Matthew Hartman, partner, Betaworks Ventures

- Jerry Lu, senior associate, Maveron

- Jana Messerschmidt, partner, Lightspeed Venture Partners

- Michael Palank, general partner, MaC Venture Capital (with supplementary insights from MaC’s Marlon Nichols)

- Pär-Jörgen Pärson, general partner, Northzone

- M.G. Siegler, general partner, GV

- Laurel Touby, managing director, Supernode Ventures

- Hans Tung, managing partner, GGV Capital

Typically, we present each investor’s responses individually. However, for this particular survey, we have organized the responses according to the questions asked. Some readers find these surveys helpful when researching individual VCs prior to making a pitch, so please share your preferred format with us.

Is a valuation of $27 billion to $29 billion justified for Databricks?

Databricks, the data analytics platform, is currently seeking new investment which could result in a company valuation falling between $27 billion and $29 billion.

Databricks, the data analytics platform, is currently seeking new investment which could result in a company valuation falling between $27 billion and $29 billion.As of the close of the third quarter of 2020, Databricks had achieved a run rate exceeding $350 million – representing a $150 million increase compared to the same period in the previous year, as noted by Alex Wilhelm.

Wilhelm characterized the organization at that time as a strong contender for an initial public offering, while also possessing considerable flexibility in private funding avenues.

This leads to the inquiry: “Is it possible to establish a financial framework that supports a $27 billion valuation for Databricks?”

End-to-end operators represent the future of direct-to-consumer businesses

Significant changes in consumer purchasing habits have fundamentally altered traditional marketplaces, rendering resources like classified ads and phone directories obsolete.

Significant changes in consumer purchasing habits have fundamentally altered traditional marketplaces, rendering resources like classified ads and phone directories obsolete.Currently, it’s possible to utilize a smartphone to request services from a plumber, order a full supply of groceries, or arrange transportation to a medical appointment.

Companies functioning as end-to-end operators, such as Netflix, Peloton, and Lemonade, require substantial investment and effort to achieve widespread adoption, however, “the increased financial investment is frequently offset by the benefits of controlling the complete customer journey.”

Analyzing Chamath Palihapitiya’s SPAC Transactions Involving Latch and Sunlight Financial

Chamath Palihapitiya, the CEO of Social Capital, announced on January 25th that he was pursuing two special purpose acquisition company (SPAC) agreements.

Chamath Palihapitiya, the CEO of Social Capital, announced on January 25th that he was pursuing two special purpose acquisition company (SPAC) agreements.Latch, a provider of enterprise software as a service, specializes in keyless entry solutions. Simultaneously, Sunlight Financial focuses on providing financing options for homeowners looking to install residential solar power systems.

According to Alex Wilhelm, who examined these deals in detail, approximately 300 SPACs are currently active and seeking acquisition targets.

Wilhelm also commented that SPAC activity is expected to remain prominent in the near future, suggesting that those who dislike the trend of private companies entering the public markets via SPACs may find the coming months challenging.

Financial Technology Companies Projected to Generate $100 Billion in Liquidity During 2021

We released the Matrix Fintech Index on Monday, a comprehensive, three-part analysis that assesses industry dynamics by examining liquidity, performance in public markets, and developments in e-commerce.

We released the Matrix Fintech Index on Monday, a comprehensive, three-part analysis that assesses industry dynamics by examining liquidity, performance in public markets, and developments in e-commerce.Over the past four years, firms such as Afterpay, Square, and Bill.com have consistently delivered returns exceeding those of the S&P 500 and established financial institutions.

Considering consistent venture capital funding, growing customer acceptance, and a robust schedule of initial public offerings, the financial technology sector is considered “one of the most compelling and significant innovation periods of the current decade.”

Drupal’s evolution from a student initiative to a significant financial achievement

January 15, 2001, marked the initial release of Drupal 1.0.0, an open-source content management system, created by then-university student Dries Buytaert. At that point in time, approximately 7% of the global population had access to the internet.

January 15, 2001, marked the initial release of Drupal 1.0.0, an open-source content management system, created by then-university student Dries Buytaert. At that point in time, approximately 7% of the global population had access to the internet.Following substantial investment exceeding $180 million, Buytaert completed a sale to Vista Equity Partners valued at $1 billion in 2019.

Ron Miller, a journalist covering enterprise technology, conducted an interview with Buytaert to gain deeper insights into his 18-year experience.

According to Ron, “Buytaert’s experience is both inspiring and provides valuable guidance for startup founders aiming to create substantial ventures.”