despite pandemic, forecasts predict us online holiday sales increase of 20%-30% or more

Predictions indicate robust online sales will contribute to an increase in overall holiday retail expenditure in the United States, as outlined in recent forecasts from the National Retail Federation (NRF) and eMarketer. Both organizations anticipate growth in retail sales throughout November and December, although a potential slowdown in traditional store sales could influence the market.

The NRF presented the more favorable projection, estimating a year-over-year rise in U.S. holiday sales between 3.6% and 5.2% for November and December, totaling between $755.3 billion and $766.7 billion. This compares to a 4% increase recorded in 2019, reaching $729.1 billion, and an average increase of 3.5% over the preceding five years.

The anticipated growth is expected to originate from online and non-store sales, which are factored into the total, and are projected to increase by 20% to 30%, reaching between $202.5 billion and $218.4 billion. This represents an increase from the $168.7 billion recorded last year.

The anticipated growth is expected to originate from online and non-store sales, which are factored into the total, and are projected to increase by 20% to 30%, reaching between $202.5 billion and $218.4 billion. This represents an increase from the $168.7 billion recorded last year.The NRF suggests that consumers are prepared to spend, potentially driven by the difficulties experienced throughout 2020.

“Considering the challenges they’ve faced, we believe consumers will feel a desire to treat themselves and their families to a more substantial holiday season than usual,” stated NRF Chief Economist Jack Kleinhenz. “While economic risks remain if the virus continues to spread, consumer confidence and optimism will likely support holiday spending,” he added.

The organization also pointed out that consumers may have decreased spending in areas such as personal services, travel, and entertainment due to the pandemic, potentially freeing up funds for retail purchases.

eMarketer, conversely, offers a less optimistic outlook regarding overall sales.

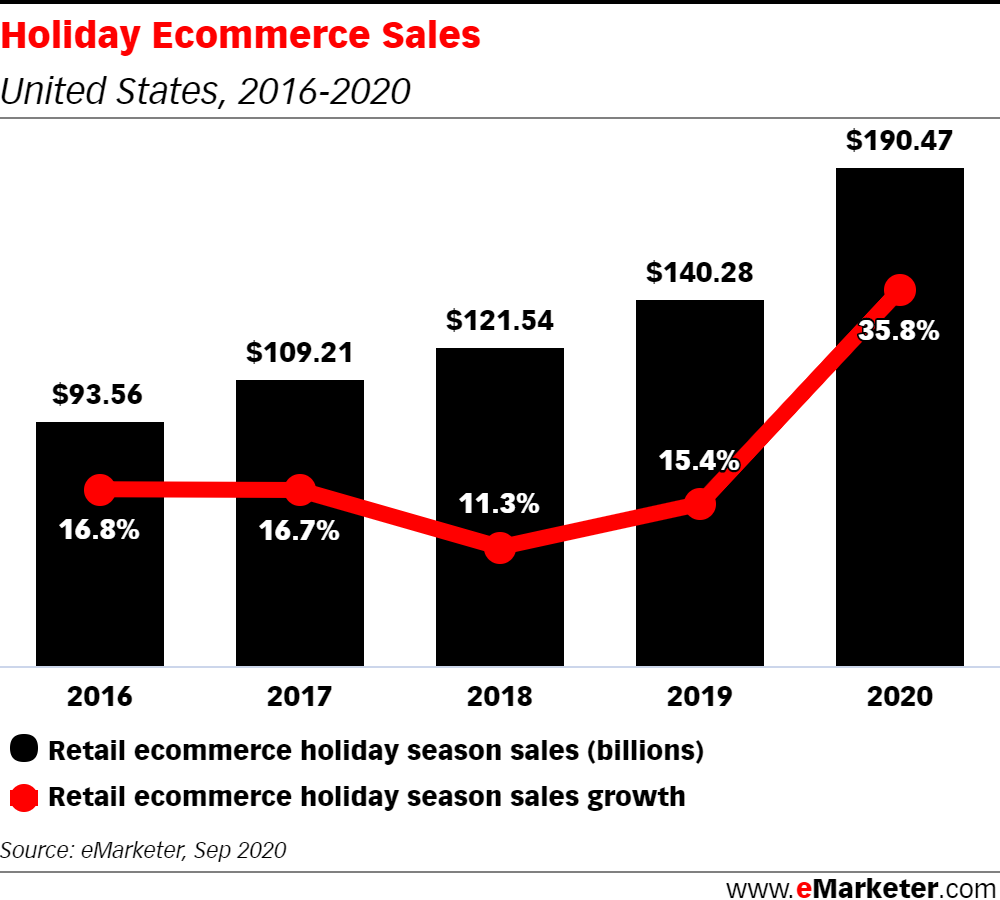

The firm forecasts a total holiday season retail sales growth rate of just 0.9% year-over-year. This growth will be primarily driven by the e-commerce sector, which is expected to experience its highest growth rate – 35.8% – since the firm began tracking retail sales in 2008. Traditional brick-and-mortar sales, however, are predicted to decline by 4.7%.

The difference in these firms’ estimates stems from their respective methodologies for calculating “retail sales.”

eMarketer’s estimates encompass auto and gasoline sales but exclude restaurants, travel, and event sales. NRF’s figures, in contrast, exclude auto, gasoline, and restaurants.

However, both organizations concur on the anticipated surge in e-commerce. NRF notes that online sales were already up 36.7% year-over-year in the third quarter, partly due to consumers beginning their holiday shopping earlier. The firm recently found that approximately 42% of consumers had initiated their shopping earlier than usual. Furthermore, retail sales increased by 10.6% in October 2020 compared to October 2019, as indicated in its forecast.

Regardless of whether growth reaches 20% to 30% or 35.8%, depending on the source, it is evident that e-commerce is playing a crucial role in sustaining the retail sector.

NRF also anticipates seasonal hiring levels consistent with recent years, with retailers employing between 475,000 and 575,000 seasonal workers, compared to 562,000 in 2019. Some of this hiring may have occurred earlier in October, due to the early start to holiday shopping, the organization stated.

While Black Friday may not experience the same level of in-store traffic as in previous years, brick-and-mortar retailers have enhanced their digital shopping options, offering shipping, in-store pickup, and curbside service. Beyond Amazon, Walmart and Target have particularly benefited from investments in e-commerce, exceeding Wall Street expectations in their latest earnings reports, released prior to the holiday season.

However, Cyber Monday is expected to remain the dominant online shopping day, according to eMarketer.

Of the five major online shopping days in 2020, eMarketer predicts Cyber Monday will once again surpass Black Friday in overall e-commerce sales, reaching $12.89 billion compared to Black Friday’s $10.20 billion. Thanksgiving Day is projected to experience the highest year-over-year growth in e-commerce sales, at 49.5%, followed by Black Friday, Small Business Saturday, Cyber Sunday, and Cyber Monday.

Of the five major online shopping days in 2020, eMarketer predicts Cyber Monday will once again surpass Black Friday in overall e-commerce sales, reaching $12.89 billion compared to Black Friday’s $10.20 billion. Thanksgiving Day is projected to experience the highest year-over-year growth in e-commerce sales, at 49.5%, followed by Black Friday, Small Business Saturday, Cyber Sunday, and Cyber Monday. In a mobile forecast, analytics firm App Annie predicted that Americans would spend over 110 million hours in shopping applications on Android devices during the two-week period encompassing Black Friday and Cyber Monday weeks. The firm noted that the pandemic had already accelerated mobile device usage to 4 hours and 20 minutes per day, and Americans spent over 61 million hours shopping during the week of Prime Day.

In a mobile forecast, analytics firm App Annie predicted that Americans would spend over 110 million hours in shopping applications on Android devices during the two-week period encompassing Black Friday and Cyber Monday weeks. The firm noted that the pandemic had already accelerated mobile device usage to 4 hours and 20 minutes per day, and Americans spent over 61 million hours shopping during the week of Prime Day.